Could AI Help You Make Smarter Investments?

Author

CoinIQ

Date Published

Investing in cryptocurrencies can be tricky, especially with their fast-changing prices. Many individuals seek smarter ways to invest and make informed decisions. Artificial intelligence (AI) is emerging as a supportive resource in this realm. By analysing patterns and trends, AI can provide insights that may assist you in determining the appropriate moments to buy or sell. Let’s consider how AI could simplify your crypto investments and potentially enhance your profits.

The Role of AI in Cryptocurrency Investment

Artificial intelligence can change the way investors assess trends in crypto markets, providing clarity through sophisticated data analysis. By analysing extensive datasets from blockchain activities, AI can reveal patterns that may be overlooked by human analysts. This aids investors in making informed decisions regarding asset value and potential returns.

Furthermore, AI can improve risk management strategies, identifying weaknesses in business models or in particular cryptocurrencies that may be vulnerable to theft. Its capacity to evaluate market conditions can avert margin calls and enhance investor reactions during times of market fluctuation. However, obstacles exist; for instance, integrating AI necessitates a solid understanding of machine learning principles and may pose challenges for those less familiar with technology.

Additionally, investors must uphold compliance with regulations concerning preferred stocks and legal personhood. As AI continues to advance, its ability to analyse data in mergers and acquisitions can also shape strategies within the equity market. Striking a balance between sophisticated investment approaches and technological capabilities will be significant for success in this changing environment.

Could AI Help You Invest Smarter in Crypto? Understanding Market Trends

AI technologies can analyse and interpret market trends in cryptocurrency by examining data patterns and fluctuations in asset value. For instance, AI can process vast amounts of information on blockchain transactions, identifying trends that human investors might overlook. This clarity can lead to smarter investment strategies, such as predicting price movements or recognising profitable dividend opportunities linked to preferred stocks.

AI-driven tools may also enhance decision-making by providing insights into when to buy or sell, thereby reducing the chances of margin calls or losing investments due to sudden market changes. However, investors must be aware of potential vulnerabilities in AI systems, such as the risk of exploits or the context-sensitive nature of smart contracts.

It's also important to acknowledge that while AI can assist in understanding complex elements of investing, it cannot replace the nuanced judgement of an investment banker making decisions on mergers and acquisitions.

Finally, investors should remain cautious of the risks of stealing crypto and the implications of legal personhood in investment choices, as AI's guidance does not eliminate all uncertainties in the equity market.

AI-Driven Analysis Tools for Investors

AI-driven analysis tools provide clarity in understanding cryptocurrency markets by assessing vast amounts of data, identifying trends, and highlighting vulnerabilities. These tools can analyse blockchain transactions to detect potential exploits, assisting investors in avoiding theft or fraud, such as the stealing of crypto.

By evaluating asset value in relation to investments like preferred stocks or dividends, they help investors make informed decisions regarding payment obligations and margin calls. Furthermore, these tools enhance the accuracy of market predictions and risk assessments by using artificial intelligence to evaluate patterns and respond to changes in the equity market, mergers and acquisitions, or shifts in the USD reserve.

Investors can integrate AI-driven tools into their strategies by employing them to analyse smart contracts, evaluate business models, and refine their investment approaches based on data insights, thus increasing their chances of making profitable decisions.

Benefits of Using AI in Crypto Trading

Increased Accuracy in Predictive Analytics

Enhanced accuracy in predictive analytics significantly boosts the effectiveness of AI in cryptocurrency investment strategies. By leveraging advanced algorithms, AI clarifies market trends, aiding investors in deciding when to buy or sell crypto assets.

For example, if an AI model predicts that a particular token will rise in value, investors can act on that information, potentially yielding dividends or strengthening their position in the equity market. Improved predictive analytics enhances decision-making in the volatile cryptocurrency market by pinpointing patterns that might lead to margin calls or payment obligations, allowing investors to adjust their portfolios to mitigate risks. However, potential limitations exist, including the exploitation of vulnerabilities in blockchain systems or the inherent unpredictability of markets.

Factors such as legal personhood and fluctuations in a USD reserve value can still influence predictions, reminding investors that while AI provides valuable insights, it does not remove risks altogether. Thus, a combination of informed strategies and ongoing market observation is crucial for successful cryptocurrency investments.

Risk Management Enhancements

AI can significantly enhance risk management in cryptocurrency investment strategies by providing clarity on asset value, especially when dealing with smart contracts and vulnerable blockchain systems. For instance, AI-driven tools can identify potential exploits in coding, helping investors avoid situations where stealing crypto becomes possible. By analysing historical data, AI can alert users to risks such as margin calls or payment obligations linked to preferred stocks.

This improves investment bankers’ approaches to mergers and acquisitions, as AI highlights weaknesses in business models.

Additionally, AI tools can simulate different market scenarios, refining strategies around dividends and USD reserves. This can lead to smarter investment choices in the equity market. By systematically addressing vulnerabilities, AI fosters security among investors, boosting their confidence in crypto markets overall. With improved risk management practices, investors may feel more comfortable navigating the complexities of this evolving space, knowing they have support in recognising potential challenges and protecting their investments.

Potential AI Platforms for Crypto Investment

Numerai

Numerai presents a distinctive strategy for investors looking to integrate artificial intelligence into cryptocurrency trading through crowd-sourced prediction models. This approach combines various data sources, providing insight into market trends and asset valuations. Participants, ranging from experienced investment bankers to beginners, share their analyses of crypto prices and market fluctuations, drawing on tactics familiar in mergers and acquisitions.

This collective intelligence highlights weaknesses and opportunities within the blockchain, enhancing the precision of forecasts.

Additionally, Numerai's business structure, bolstered by smart contracts, improves risk management methods by automating payment responsibilities associated with dividends, preferred stocks, and margin calls. By departing from conventional equity market methods, it aids investors in formulating more resilient investment strategies. The implementation of a USD reserve system further supports return stability and reduces the risks associated with crypto theft, ensuring a safer environment for users. This blend of innovative elements enables a more efficient investment approach, ultimately facilitating better decision-making amidst the unpredictable crypto market.

TradeSanta

Artificial intelligence enhances trading strategies on cryptocurrency platforms by quickly and accurately analysing extensive datasets. An AI system can scrutinise market trends, concentrating on factors such as asset value changes and payment obligations to pinpoint patterns that may elude human traders. The platform includes features designed for clarity in analysis, facilitating easier assessment of opportunities and risks for users.

For example, users can obtain information about preferred stocks or trading activities, which aids in shaping their investment approaches.

Additionally, addressing risks is important, particularly considering the weaknesses in blockchain technology that could allow for the theft of cryptocurrency. By implementing smart contracts, the platform can automate trades based on predetermined criteria, thereby minimising the likelihood of expensive margin calls. This method not only assists users in making well-informed decisions, similar to an investment banker’s role during mergers and acquisitions, but also fosters a comprehensive strategy for asset management. Furthermore, maintaining a USD reserve can offer extra stability during market fluctuations.

CryptoHopper

CryptoHopper is designed with features that provide clarity for traders, assisting them in navigating the complexities of crypto investments. It employs artificial intelligence to enhance predictive analytics, enabling users to forecast market trends and target assets with the potential for high returns. This AI-driven system can pinpoint weaknesses in trading strategies, revealing potential vulnerabilities that might jeopardise an investor's capital or even lead to scenarios of crypto theft.

To enhance trading performance, it connects to blockchain technology, ensuring smart contracts are executed, which secures payment obligations and minimises margin calls.

Additionally, CryptoHopper’s business model incorporates investment strategies that mirror the practices of investment bankers, including techniques used in mergers and acquisitions. By treating each digital asset like preferred stocks within the equity market, it enables investors to better understand asset value.

CoinIQ

We created CoinIQ because we were frustrated with how most crypto tools only show numbers on a screen. Investors were left with charts that display prices but not performance, volatility without context, and returns without meaning. We wanted to change that by helping crypto investors make sense of their data and move from guesswork to genuine insight.

CoinIQ turns crypto investing from speculation into strategy. It connects all your wallets and exchanges in one clear place, where you can see how your portfolio is really doing. You can monitor risk, diversification, and performance in real time while also seeing the story behind the numbers. The platform combines on-chain data, market sentiment, staking and yield information, liquidity insights, and even an assessment of your trading decisions to give you a complete view of your portfolio.

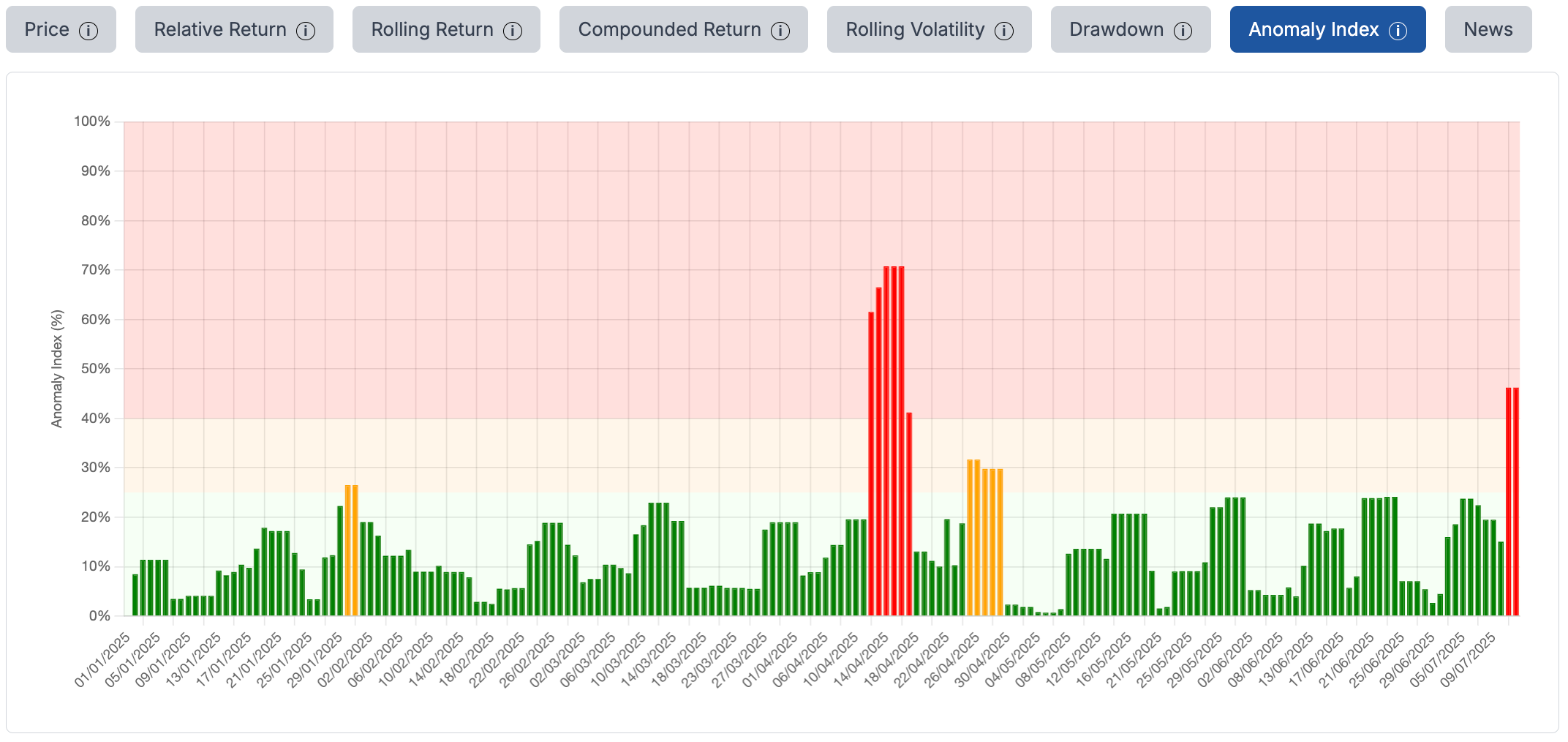

It includes tools designed to protect and empower you. The Anomaly Index alerts you to unusual price or liquidity spikes so you can catch risks early. AI-driven suggestions help you rebalance your portfolio intelligently. Automated summaries pull in only the news that matters to your holdings. And with built-in swap functionality, you can act on insights immediately instead of switching between platforms.

What makes CoinIQ stand out is its balance of depth and simplicity. It is not a complex analytics terminal made only for professionals, and it is not a simple tracker that tells you what you already know. It is built for investors who want clarity, control, and smarter decision-making in a market that often feels chaotic.

CoinIQ uses a freemium model so anyone can start. The free Explorer plan gives you access to powerful analytics and tracking, while the paid tiers unlock advanced AI insights, anomaly detection, and rebalancing features.

Whether you are just starting out or managing a serious portfolio, CoinIQ helps you cut through the noise and invest with confidence.

(CoinIQ's Anomaly Index helps identify potential rug pulls.)

Challenges of Integrating AI in Crypto Investment

The volatility of the cryptocurrency market presents challenges for integrating artificial intelligence into investment strategies. Sudden price swings can result in significant losses, making it tough for AI systems to predict asset values accurately. This unpredictability hinders AI's effectiveness in formulating clear strategies, such as selecting preferred stocks or identifying profitable smart contracts.

Regulatory uncertainties also create problems, as shifting laws can influence payment obligations and the legal status of digital assets. Such fluctuations can impact how AI is programmed to assess risks and calculate dividends based on a USD reserve. Furthermore, the lack of quality data can seriously limit AI’s ability to provide clarity in investment decisions.

For example, if data is biased or incomplete, it may lead to incorrect assessments of vulnerabilities or unforeseen exploits that threaten cryptocurrency security.

Could AI Help You Invest Smarter in Crypto? Evaluating Performance

AI-driven tools can enhance the performance evaluation of cryptocurrency investments by offering clarity on trends and potential vulnerabilities in the market. These tools can assess vast amounts of historical data, assisting investors in identifying profitable business models, smart contracts, and even assets that yield dividends. By analysing patterns of asset value fluctuations or forecasting market reactions, AI empowers investors to formulate more robust investment strategies.

Investors might concentrate on metrics such as the cost of margin calls, trends in the equity market, and the influence of USD reserves on crypto prices.

Additionally, by examining exploits and issues related to crypto theft, investors can better anticipate risks. Transaction records on the blockchain provide an extra layer of insights, revealing how legal personhood affects investment decisions.

Future of AI in Cryptocurrency Investment

Advancements in AI technology may reshape investment strategies in the cryptocurrency market by providing clarity on asset value and identifying vulnerabilities in trading systems. AI can analyse vast amounts of data to spot trends and recommend smart contracts that offer better returns than traditional equities or preferred stocks. It could also enhance business models by creating robust platforms that assist investors in managing payment obligations and margin calls.

However, there are ethical implications that may arise, such as the risks of stealing crypto or the exploitation of traders through manipulative strategies. As AI becomes more integrated, platforms may evolve to emphasise legal personhood in transactions and ensure accountability, thereby fostering trust. AI's impact on predicting mergers and acquisitions in the crypto sector could alter how investment bankers strategise.

FAQ

What are the benefits of using AI for cryptocurrency investment?

AI enhances cryptocurrency investment by providing data analysis, predicting market trends, and automating trading strategies. For example, AI algorithms can identify profitable trading patterns and execute trades at optimal times, maximising returns while minimising risks.

How can AI analyse market trends and predict price movements in crypto?

AI analyses market trends using historical data, sentiment analysis, and technical indicators.

For example, machine learning algorithms can detect patterns in trading volumes or social media sentiment, helping predict price movements. Tools like predictive analytics platforms or algorithmic trading bots can implement these insights for actionable strategies.

Are there reliable AI tools available for crypto trading?

Yes, reliable AI tools for crypto trading include platforms like 3Commas, Cryptohopper, and Zignaly. These tools offer automated trading, signals, and portfolio management to enhance decision-making and maximise profits. Always conduct thorough research and consider starting with small investments.

Can AI help in managing risks associated with cryptocurrency investments?

Yes, AI can analyse market trends, predict price movements, and assess risks. For example, machine learning algorithms can identify patterns in trading data, while sentiment analysis tools can gauge market sentiment from news and social media, helping investors make informed decisions to mitigate risks.

How does AI compare to traditional investment strategies in the crypto market?

AI offers data-driven insights and faster analysis compared to traditional strategies. For example, AI algorithms can execute trades based on real-time sentiment analysis from social media, while traditional investors rely on historical data and market trends, potentially missing rapid market shifts.

See how DeFi is evolving with consumer-friendly apps, real-world assets, and platform-based innovation - marking a pivotal shift in onchain finance.

What was once a speculative concept, issuing and settling real-world assets on public blockchains, is now surging into reality. Follow the discussion.

Explore the concept of style factor investing in crypto, examining its existence, implications, and relevant data.