The Great On‑Chain Migration: Tokenization Becomes Inevitable

Author

CoinIQ Admin

Date Published

What was once a speculative concept, issuing and settling real-world assets on public blockchains, is now surging into reality.

Tokenization Hits a Tipping Point

In early 2025, over $24 billion worth of real-world assets (RWAs) had migrated onto public blockchains, tripling since the start of 2023. Nearly 200 institutional issuers, including the likes of BlackRock, Franklin Templeton, Siemens, and J.P. Morgan, have placed real capital on‑chain for the first time. McKinsey forecasts tokenized market capitalisation could hit $2–4 trillion by 20301.

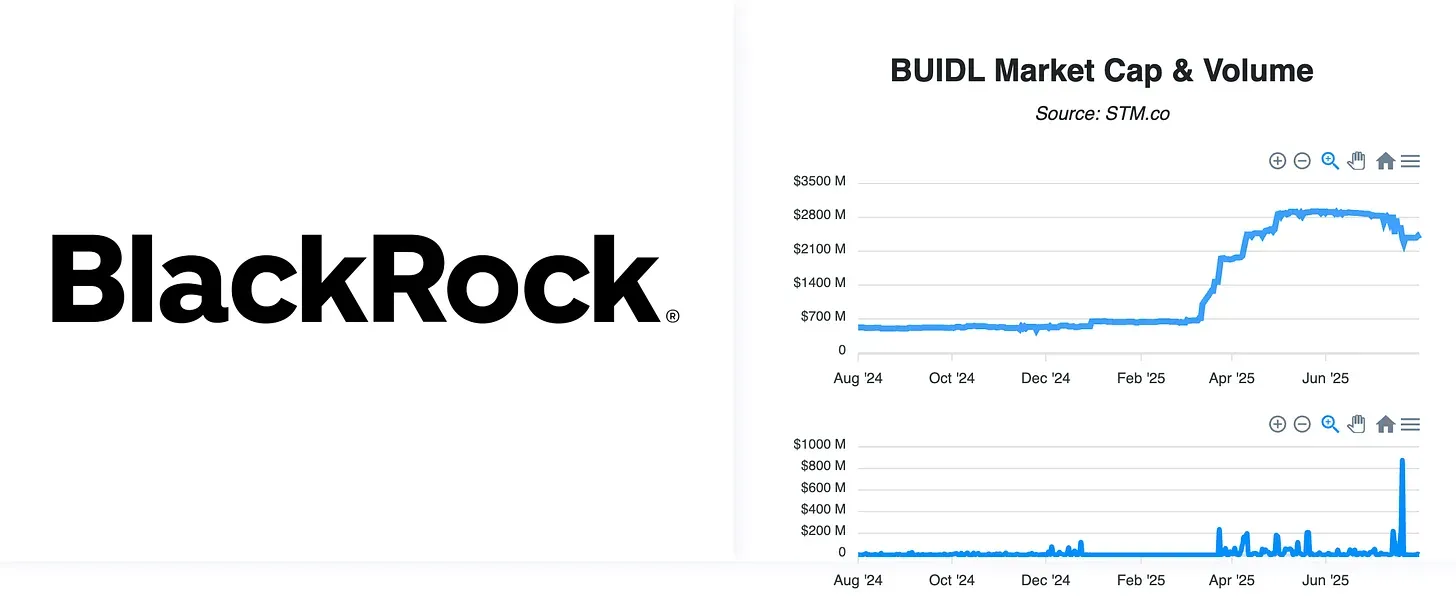

BlackRock’s BUIDL Fund, the largest tokenized treasury product, earned $1.4 billion in AUM within months of launch and now represents a significant share of the $4 billion tokenized Treasury market2. Securitize, the SEC‑registered transfer agent, has already tokenised $4 billion+ in assets on-chain, including BlackRock’s BUIDL, Exodus equity fund, and Apollo’s credit fund.

Robinhood Goes Deep with Arbitrum and Its Own Chain

Robinhood’s big reveal in June 2025 saw3:

- Tokenised versions of 200+ US stocks and ETFs made available to EU users on Arbitrum, accessible 24/5 with dividend support and commission-free trading.

- Plans to migrate to Robinhood Chain, an own-built Layer‑2 network based on Arbitrum, designed for 24/7 global trading, self‑custody, and tokenised equity issuance.

- Robinhood stock surged over 12%, reaching record highs, as investors cheered the pivot to tokenised infrastructure.

Financial Physics in Motion

On-chain features check all the boxes:

- Global, 24/7 access

- Lower costs via programmable rails

- Full composability and transparency

As liquidity flows in, tokenized markets, from Treasury to equities, are becoming the centre of gravity for price discovery and capital formation.

Rail Replacement at the Core

Fintech firms like Robinhood and Coinbase (via its Base chain) are focused on owning the rails, sequencer, custody, trading engine, rather than merely layering user interface over legacy systems. The new model:

- Tokenises assets on-chain at near-zero deployment cost (Robinhood minted 213 stock tokens for just ~$5 in gas fees!)4.

- Lets third-party developers build composable apps (lending, structured products, insurance) on top of shared liquidity.

- Internalises trading spread, custody fees, and infrastructure rent to create vertical integration.

Institutional Issuance Goes On‑Chain

The old guard is onboard:

- BlackRock’s BUIDL fund now exceeds $1.4 billion AUM in just months.

- Securitize’s issuance footprint includes billions of US Treasuries, private credit, and tokenised equity funds.

- Goldman Sachs and BNY Mellon have launched tokenized funds on private chains, around $6.7 billion in tokenized U.S. Treasuries so far, and promise broader institutional adoption.

These are not pilots, they’re a full-scale rethink of capital-markets architecture to leverage blockchain benefits like instant settlement and global reach.

Rights, Not Just Tokens

One gap remains: true shareholder rights. Today’s stock tokens mirror equity value (often via SPVs or custodial wrappers), but corporate governance rights, voting, inspections, stay anchored off-chain. That’s changing pressure, and how it resolves will define on‑chain issuance’s future. As SEC Commissioner Hester Peirce noted: tokenization is promising, but only transformational if it moves beyond wrapping assets to issuing them natively on‑chain5.

When Tokenization Hits “ETF‑Moment”

Tokenization’s trajectory could soon mirror ETFs, once tokenised volume consistently rivals long-tail ETFs or ADRs, structural change will follow. Indicators to watch:

- Daily on-chain equity volume breaching $1 billion

- Tokenized equity AUM topping $100 billion

- A top-tier public company trading more liquidity on-chain than via legacy exchange

- A global IPO listing issuing on-chain directly, bypassing traditional exchanges

Current monthly volume hovers around $300 million, and is up ~350% month-over‑month thanks to recent institutional and retail launches like Robinhood and Ondo Global.

What Comes Next?

If tokenization continues accelerating:

- Blockchains will become the default rails for global capital markets, always on and universally accessible.

- Fintechs, corporates, and funds will compete not just on product, but on infrastructure and liquidity.

- Retail, institutional and corporate capital will converge on the same programmable rails.

The rails now exist, liquidity is flowing, and the gravity well is real. The mass migration is underway and tokenization’s “ETF moment” is no longer a question of if, but when.