Three Emerging Trends in DeFi

Author

CoinIQ

Date Published

DeFi is growing up. With consumer-friendly products, institutional-grade assets, and developer-ready infrastructure, the space is entering a more sustainable, expansive phase.

Consumer-Ready DeFi Is (Finally) Within Reach

After years of DeFi feeling like it was built exclusively for crypto power users and keyboard warriors, we’re finally seeing a shift toward consumer-friendly products.

Why now? A few reasons. First, as interest rates begin to slide back down, DeFi yields are starting to look more attractive again. More volatility in the markets brings more users, more trading, more leverage, and, ultimately, more yield. When you mix that with sustainable returns from real-world assets (RWAs) onchain, suddenly it becomes much easier to build crypto financial apps that actually make sense for everyday users.

Add in smoother onboarding tools like smart wallets, chain abstraction (read: less confusing UX), and a general pivot to mobile-first design, and the case for mass-market DeFi is stronger than ever.

In fact, some of the most successful crypto apps recently have nailed the formula by combining slick UX with just the right amount of speculation:

- Trading bots in Telegram – They’re letting people trade straight from their chat apps.

- Wallets like Phantom – They’ve cleaned up the user experience and made multichain use actually usable.

- Tools like Photon or Dexscreener – They act as powerful dashboards that give traders a CeFi-style interface for DeFi.

- Mobile-first meme trading (Vector, Moonshot, Hype) – Think Robinhood for memecoins, optimised for the phone in your pocket.

- Token launchpads (Pump, Virtuals, etc.) – Letting anyone spin up a new token with zero coding skills.

What’s happening here is that DeFi apps are starting to look and feel more like fintech. Sure, there’s still a DeFi engine under the hood, but to the user, it just works. The best products will offer curated access to protocols, simplified discovery, and smart defaults, all while hiding the messiness of onchain interaction.

The RWA Flywheel Is Kicking In

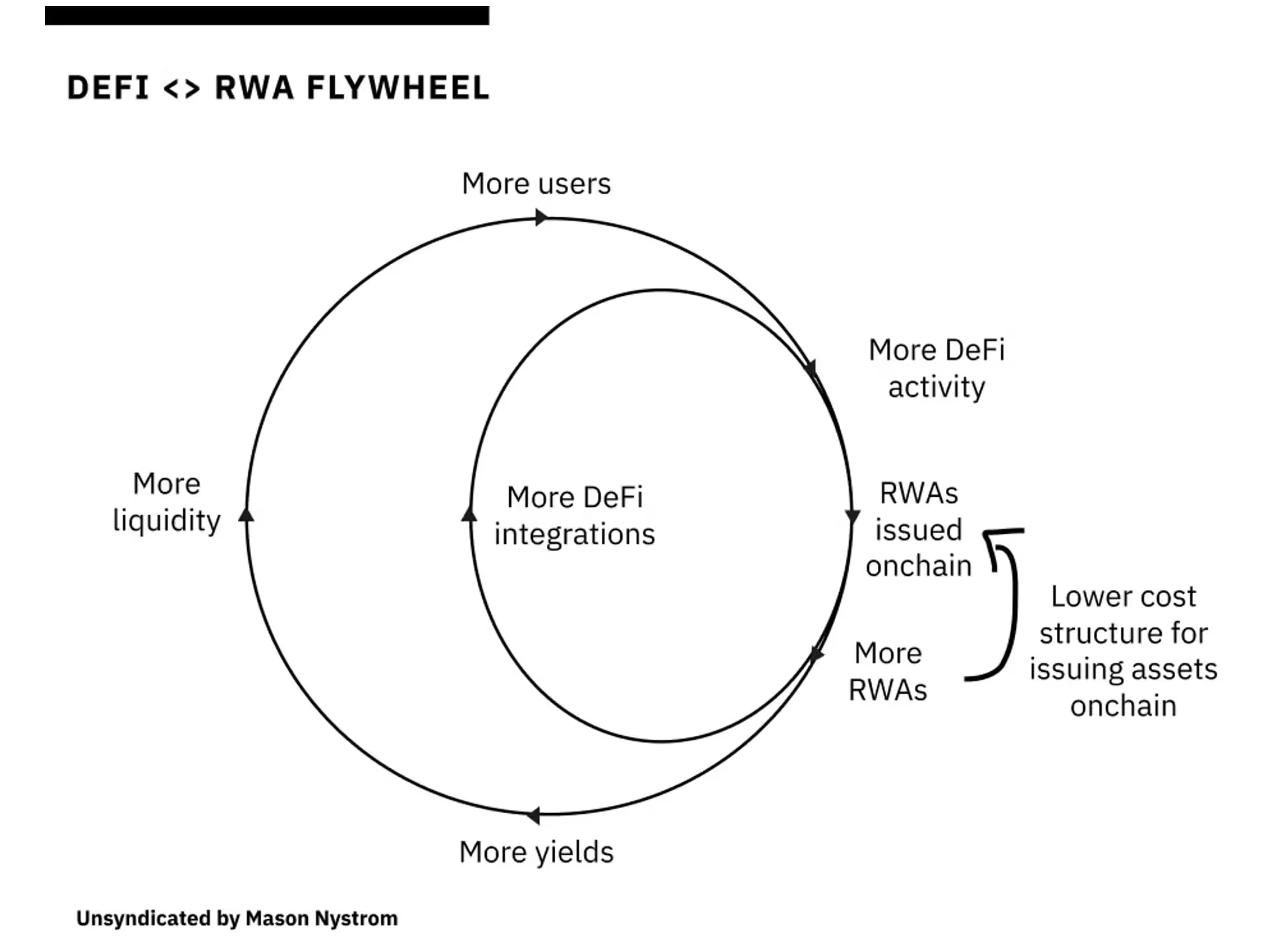

RWAs (real-world assets) coming onchain have gone from a niche experiment to a full-blown trend, and the effects are starting to snowball.

Since rates spiked in 2022, we’ve seen a flood of capital into tokenised Treasury bills and other yield-bearing RWAs. Now, the conversation is shifting from “Why?” to “Why not?” Large asset managers like BlackRock have realised the advantages: programmable assets, better margins, and easier access.

According to RWA.xyz and DeFiLlama, RWAs now make up over 20% of Ethereum’s total assets. That’s a lot of U.S. Treasury exposure, and while rising rates played a key role, the long-term story is bigger. Now that these assets are onchain, Wall Street has effectively opened the door to onchain finance, and the door’s not shutting any time soon.

But here’s the bigger picture: DeFi growth has historically been driven by endogenous capital (money already inside the system). That creates a sort of feedback loop, prices go up, usage increases, things get hyped, and then... everything crashes again.

RWAs, on the other hand, are exogenous capital. They bring in fresh liquidity from outside the crypto bubble. They also represent a huge opportunity to shift from speculative gambling to real, productive finance. Just like stablecoins moved beyond trading into savings and remittances, RWAs could be DeFi’s gateway into everything from commodities to equities to credit markets.

The Trojan horse is already inside the gates. And it’s pulling in trillions.

The Platformization of DeFi Is Underway

Ben Thompson once said platforms are powerful because they create value between third-party suppliers and end users. Well, DeFi is now following that same playbook.

DeFi protocols are evolving. They’re no longer just standalone apps like “a lending app” or “a DEX.” Instead, they’re becoming platforms, modular systems that others can build on top of.

Let’s take Uniswap as an example. The earlier versions (V2 and V3) were simple swap interfaces. With V4, they’re introducing hooks that let developers plug directly into Uniswap’s liquidity layer to create custom experiences. It’s not just a DEX anymore; it’s a liquidity platform.

This trend is powered by something called singleton liquidity primitives. These are shared liquidity layers that other apps can tap into without having to spin up siloed pools. That means:

- Liquidity providers can plug in once and reach a broad set of users.

- Apps can rent access to liquidity and offer unique features on top.

Morpho is doing this with its MorphoBlue core layer, letting vaults plug in and build lending strategies. Instadapp’s Fluid protocol works similarly for both lending and DEX services.

The result? More customisation, more composability, and more innovation.

In short, DeFi’s entering its Stripe moment: the era of offering developers a base layer they can easily build on, unlocking a whole new generation of use cases.

Looking Ahead

Between consumer-grade apps, the unstoppable RWA wave, and the rise of DeFi platforms, we’re entering a new chapter for onchain finance. It’s not just about protocols anymore. It’s about products people want to use, institutions that see value, and developers who can build without reinventing the wheel.

DeFi’s not done evolving, it may only just be getting started.