Analysis of Emerging Digital Asset Protocols: December 2025 Market Overview

Author

CoinIQ

Date Published

The cryptocurrency landscape in 2025 continues to diversify into specialized sectors such as decentralized storage, healthcare infrastructure, and real world asset tokenization. By examining specific protocols, we can better understand the technological shifts occurring within the broader blockchain ecosystem. This guide provides an objective overview of several notable projects, ranging from decentralized science to social community platforms.

Decentralized Social Ecosystems: Frenly ($FRENLY)

Frenly, often identified by the handle GetFrenly, is a social community token operating primarily on the Base network. The protocol aims to facilitate social interactions and community building through decentralized mechanisms. By leveraging the low transaction costs and scalability of the Base layer 2 solution, Frenly provides a framework for user engagement that is independent of centralized social media gatekeepers.

The utility of the FRENLY token revolves around incentivizing participation and supporting the internal economy of the GetFrenly interface. As social finance continues to evolve, protocols like Frenly explore how tokenized rewards can redefine digital community governance and peer to peer value transfer.

Blockchain in Healthcare: Lumera Health ($LUR)

Lumera Health is a decentralized infrastructure project designed to address systemic inefficiencies within the global healthcare industry. The protocol focuses on eliminating data silos and providing patients with direct control over their medical records. Utilizing a dual-consensus blockchain architecture that combines Proof of Authority and Proof of Stake, Lumera Health ensures that data exchange is both secure and compliant with global regulations such as HIPAA and GDPR.

The LUR token serves as the primary utility asset within this ecosystem. It facilitates transactions, powers the monetization of anonymized health data, and rewards validator nodes that maintain the network. Through its modular architecture, including the Lumera SuperApp and Trace Engine, the project seeks to integrate diagnostics, imaging, and insurance workflows into a single interoperable environment.

Payment Solutions and Neobanking: Avici ($AVICI)

Avici is a digital asset protocol built on the Solana blockchain, focused on providing high speed payment solutions and neobanking services. By utilizing the Solana network's high throughput and low latency, Avici aims to bridge the gap between traditional fiat banking and decentralized finance. The protocol is designed to support 24/7 global transactions with near-instant settlement times.

The AVICI token functions as a project asset that provides access to the platform’s suite of financial tools. Its integration into the Solana ecosystem allows it to benefit from established liquidity and a growing network of decentralized applications. Key features of the protocol include payment gateways and launchpad services intended to simplify the transition for users moving from traditional financial systems to digital assets.

Decentralized Cloud Storage: Storj ($STORJ)

Storj represents one of the most established implementations of decentralized cloud storage. Unlike traditional providers that rely on centralized data centers, Storj utilizes a global network of independent nodes to host data. Each file uploaded to the network is encrypted, split into numerous pieces, and distributed across thousands of uncorrelated nodes worldwide. This zero-knowledge architecture ensures that no single entity has access to the complete data set.

The STORJ token is an ERC-20 utility asset used as the medium of exchange within the network. Storage providers, or nodes, are compensated in STORJ for their contribution of bandwidth and disk space. The protocol’s focus on privacy and cost efficiency makes it a notable alternative for developers and organizations seeking secure object storage without the overhead of centralized infrastructure.

Real World Asset Tokenization: WhiteRock ($WHITE)

WhiteRock is a blockchain protocol specialized in the tokenization of traditional financial assets, such as stocks, bonds, and real estate. The primary goal of the project is to enhance global liquidity by enabling fractional ownership of regulated assets. By converting these traditional instruments into blockchain-based tokens, WhiteRock facilitates 24/7 trading and instant settlement on its dedicated high speed blockchain, known as the White Network.

The WHITE token plays a central role in the ecosystem, serving as a medium for transaction fees and protocol governance. WhiteRock also features a yield-bearing stablecoin, USDX, which is backed by U.S. Treasury bonds to provide stability within the platform. Through strategic partnerships with established custodians, the protocol aims to maintain a framework that aligns with existing financial regulations while expanding the reach of on-chain trading.

Decentralized Science: Bio Protocol ($BIO)

Bio Protocol is a pioneer in the Decentralized Science, or DeSci, sector. It serves as a launchpad and liquidity protocol designed to transform how biotechnology research is funded and governed. The platform enables the creation of BioDAOs, which are community-led organizations where researchers, patients, and participants pool resources to support biotech projects. This model focuses on funding specialized or underfunded areas of science that may be overlooked by traditional pharmaceutical companies.

The BIO token is used for governance and decision-making within the protocol. It allows holders to influence which research projects receive support and how intellectual property is managed. One of the protocol's key innovations is the tokenization of intellectual property through IP-NFTs, which allows patents and research data to be represented as tradable assets. This creates a new economy for scientific discovery where the contributors share in the long-term value of the research.

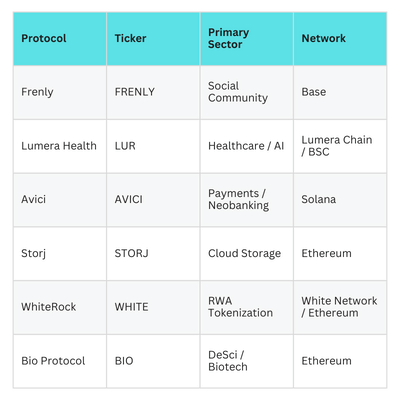

Summary of Asset Categories

To summarize the diverse roles these assets play in the 2025 market, the following table compares their primary sectors:

What was once a speculative concept, issuing and settling real-world assets on public blockchains, is now surging into reality. Follow the discussion.

Learn how to invest responsibly in crypto. A complete 2025 guide to managing digital assets with smart, risk-aware strategies.

Discover the differences between correlation and beta, their applications, and their relationships within the cryptocurrency market.