Responsibly Investing in Crypto: A Complete Guide to Managing Digital Assets in 2025

Author

Abbas A.

Date Published

What is “responsibly investing in crypto” does it even exist? In this blog, we break down practical strategies for balancing risk and reward in a fast-paced market well-known for its wild volatility.

The digital asset landscape has evolved dramatically over the past few years, transforming from a speculative playground into a legitimate investment category that demands sophisticated risk management approaches. With institutional adoption rising and markets maturing, responsible crypto investing is no longer optional—it's essential for anyone looking to build sustainable wealth in the digital economy.1

Whether you're a seasoned investor or just starting your crypto journey, understanding how to navigate this complex ecosystem whilst managing risk effectively can make the difference between spectacular gains and devastating losses. The key lies in adopting a strategic, well-informed approach that balances the incredible opportunities digital assets offer with the inherent volatility that comes with this emerging asset class.

Understanding the Digital Asset Ecosystem

Digital assets encompass far more than just Bitcoin and Ethereum. Today's cryptocurrency landscape includes a diverse array of sub-asset classes, each with distinct risk profiles, use cases, and potential returns. Understanding these categories is crucial for building a well-balanced portfolio that can weather market volatility whilst capitalising on growth opportunities.2

The main categories include native tokens like Bitcoin and Ethereum, which serve as the backbone of their respective blockchain networks. These established cryptocurrencies typically offer lower volatility compared to newer projects, making them suitable for conservative allocations within a digital asset portfolio.

Stablecoins represent another crucial category, designed to maintain price stability by pegging to fiat currencies or other stable assets. These serve as essential portfolio components for managing liquidity and reducing overall volatility during market stress periods.3

DeFi tokens power decentralised finance protocols, offering exposure to the growing ecosystem of blockchain-based financial services. These include decentralised exchanges like Uniswap, lending platforms such as Aave, and derivatives protocols, each presenting unique opportunities and risks.4

Beyond these core categories, the ecosystem includes infrastructure tokens that support blockchain operations, NFT-related assets, and emerging sectors like Real World Assets (RWAs) that tokenise traditional financial instruments.5

The Fundamentals of Responsible Crypto Investing

Responsible crypto investing begins with education and a clear understanding of what you're investing in. Unlike traditional assets with decades of performance data, cryptocurrencies operate in a relatively new and rapidly evolving environment that requires constant learning and adaptation.

Research is your foundation. Every investment decision should be based on thorough analysis rather than social media hype or fear of missing out. This means understanding the technology behind each project, examining the team's track record, analysing tokenomics, and assessing real-world adoption potential.6

Start with what you can afford to lose. The golden rule of crypto investing is to only allocate funds that won't jeopardise your financial security if lost entirely. Financial responsibility in crypto starts with treating digital assets as high-risk investments that should represent only a small portion of your overall portfolio.

Avoid emotional decision-making. The crypto market's 24/7 nature and extreme volatility can trigger intense emotional responses that lead to poor investment choices. Fear of missing out (FOMO) and fear, uncertainty, and doubt (FUD) are your enemies—stick to your predetermined strategy regardless of short-term market movements.

Implement proper security measures. Unlike traditional investments held by regulated brokers, cryptocurrency ownership places the security burden directly on you. This means using hardware wallets for long-term storage, enabling two-factor authentication on all accounts, and never sharing private keys or seed phrases with anyone.

Managing Risk-Reward Through Strategic Asset Allocation

The challenge of crypto portfolio management lies in balancing the explosive growth potential of digital assets with their inherent volatility. Different sub-asset classes within the broader digital asset category carry varying risk profiles, making strategic allocation crucial for optimising risk-adjusted returns.

Large-cap cryptocurrencies like Bitcoin and Ethereum should form the foundation of most crypto portfolios. These established assets, whilst still volatile compared to traditional investments, offer relatively lower risk within the crypto space and provide essential stability. A conservative approach might allocate 60-70% of crypto holdings to these blue-chip digital assets.7

Mid-cap altcoins present opportunities for higher returns but with increased volatility. These might include established DeFi protocols, layer-1 blockchain platforms, or infrastructure tokens with proven use cases. A balanced allocation of 20-30% to this category allows for growth potential whilst maintaining reasonable risk levels.

Small-cap and emerging tokens offer the highest growth potential but carry significant risks, including the possibility of total loss. These speculative investments should typically represent no more than 10-20% of a crypto portfolio and require active monitoring and management.

Stablecoins and tokenised yield products serve as the portfolio's defensive component, providing liquidity and reducing overall volatility. Allocating 10-15% to these instruments creates a buffer against market downturns whilst generating modest returns.8

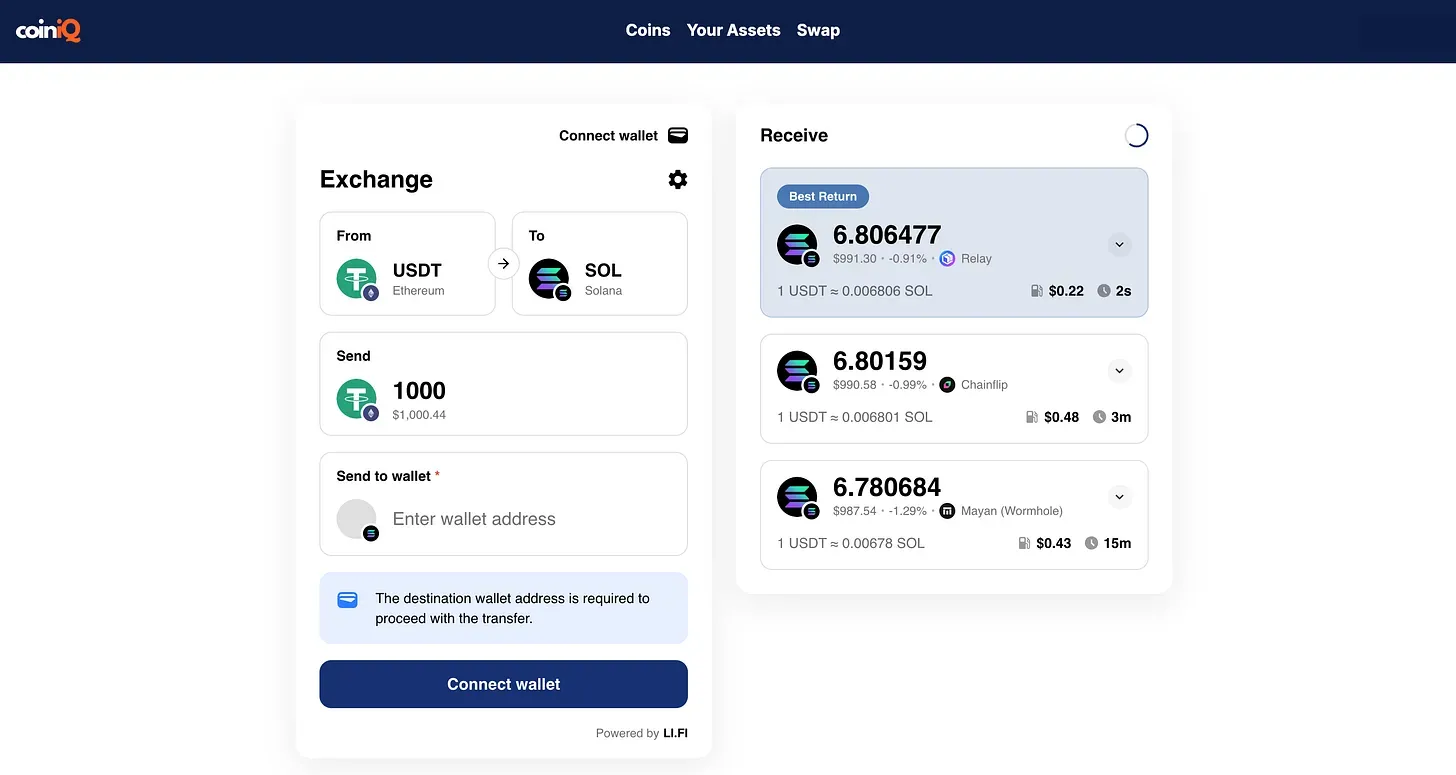

This is where sophisticated portfolio management tools become invaluable. CoinIQ, our advanced crypto portfolio management platform, transforms complex asset allocation decisions into actionable insights. By connecting all your wallets and exchanges into a unified dashboard, CoinIQ provides real-time analysis of your risk exposure across different asset categories. The platform's AI-powered analytics help identify when your portfolio allocation has drifted from target percentages, automatically flagging opportunities for rebalancing whilst monitoring correlation patterns that might indicate concentration risks you hadn't noticed.

Dynamic rebalancing becomes crucial as crypto markets evolve rapidly. CoinIQ's automated monitoring helps ensure your portfolio maintains its intended risk profile, alerting you when market movements have pushed allocations outside predetermined ranges. This systematic approach removes emotion from rebalancing decisions whilst ensuring you're consistently taking profits from outperformers and adding to undervalued positions.

The platform's anomaly detection capabilities provide an additional layer of risk management by identifying unusual patterns in your holdings or market conditions that might warrant attention. Combined with macro and on-chain insights, CoinIQ enables informed decision-making based on comprehensive data analysis rather than market sentiment or incomplete information.

Essential Risk Management Strategies

Effective crypto risk management requires a systematic approach that addresses the multiple layers of risk inherent in digital asset investing. The four-step process begins with thorough risk identification, followed by detailed analysis, comprehensive assessment, and finally, implementation of appropriate mitigation strategies.

Diversification remains your primary defence against crypto market volatility. This extends beyond simply owning multiple cryptocurrencies—true diversification requires spreading investments across different sectors within the crypto ecosystem. Consider allocating portions of your portfolio to DeFi protocols, infrastructure tokens, payment-focused cryptocurrencies, and emerging sectors like gaming or metaverse tokens.

Position sizing discipline prevents any single investment from deriving your entire portfolio. Even within crypto allocations, no individual token should represent more than 5-10% of your total digital asset holdings unless it's a blue-chip cryptocurrency like Bitcoin or Ethereum.9

Implement systematic profit-taking and stop-loss strategies. Set clear targets for taking profits when investments reach predetermined levels, and establish stop-loss points to limit downside risk. Tiered stop-losses can be particularly effective, allowing you to reduce exposure gradually rather than exiting positions entirely.10

Volatility management techniques help navigate crypto's extreme price swings. Dollar-cost averaging into positions reduces the impact of timing decisions, whilst volatility targeting adjusts position sizes based on current market conditions.

Leverage deserves special attention in crypto investing. Whilst leverage can amplify gains during favourable market conditions, it equally magnifies losses and can lead to complete portfolio destruction. If you choose to use leverage, never risk more than you can afford to lose, and consider it only after mastering spot trading.

Regular portfolio reviews and stress testing ensure your risk management framework remains effective as market conditions change. Consider how your portfolio would perform during various scenarios, including a 50% market decline, regulatory crackdowns, or major exchange failures.

Tax Considerations and Compliance

Responsible crypto investing extends to proper tax planning and regulatory compliance. The evolving regulatory landscape requires investors to maintain detailed records of all transactions and understand their tax obligations.

Transaction tracking becomes essential as crypto trading can generate dozens or hundreds of taxable events annually. Every trade, stake reward, DeFi interaction, and NFT purchase potentially creates a tax liability that must be calculated and reported accurately.

Tax-loss harvesting presents opportunities to reduce tax burdens by realising losses to offset gains. However, be aware of wash-sale rules and ensure you understand the tax implications of your trading strategy in your jurisdiction.

Regulatory compliance requirements vary by country but generally include Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures when using centralised exchanges. Stay informed about changing regulations that might affect your investment strategy.

Building Long-Term Wealth Through Strategic Thinking

Successful crypto investing requires a long-term perspective that looks beyond short-term price movements to focus on fundamental value creation. The most successful crypto investors understand that they're investing in transformative technology that will likely reshape multiple industries over the coming decades.

Focus on projects with real utility and adoption potential rather than chasing the latest meme coin or speculative trend. Whilst short-term gains can be attractive, sustainable wealth creation comes from backing projects that solve real problems and demonstrate growing user adoption.

Stay informed about technological developments and market trends that could affect your investments. The crypto space evolves rapidly, with new innovations regularly disrupting existing projects and creating new opportunities.

Maintain a balanced perspective that acknowledges both the enormous potential of digital assets and their current limitations. Avoid both excessive optimism that ignores risks and pessimism that prevents participation in a transformative asset class.

Common Pitfalls to Avoid

Even experienced investors can fall victim to crypto-specific traps that don't exist in traditional markets. Understanding these pitfalls helps you avoid costly mistakes that could undermine your investment goals.

Avoid the trap of over-diversification. Whilst diversification is important, spreading investments too thinly across hundreds of tokens makes effective management impossible and increases the likelihood of backing failed projects.

Don't ignore correlation risks. During market stress, seemingly independent cryptocurrencies often move together, reducing the benefits of diversification. Understanding these correlation patterns helps in constructing more robust portfolios.

Resist the urge to constantly trade. The 24/7 nature of crypto markets can encourage over-trading, which typically destroys returns through transaction costs and poor timing decisions. Develop a systematic approach and stick to it.

Beware of yield-chasing without understanding risks. High yields in DeFi protocols often come with smart contract risks, impermanent loss, or other hidden dangers that can exceed the yield earned.

The Future of Responsible Crypto Investing

As the digital asset ecosystem matures, responsible investing practices will become increasingly important. Institutional adoption continues to grow, with 59% of institutional investors planning to allocate over 5% of assets under management to cryptocurrencies in 2025.11

This institutional involvement brings increased scrutiny, better security practices, and more sophisticated analytical tools that benefit all participants. However, it also means that the easy gains from simply buying and holding cryptocurrencies may become less common, making strategic approach and risk management even more critical.

Environmental, social, and governance (ESG) considerations are becoming increasingly important in crypto investing, with 31% of institutional investors now incorporating ESG factors into their crypto investment frameworks. This trend suggests that sustainable and responsible projects may outperform those that ignore these considerations.12

The integration of artificial intelligence and machine learning into crypto asset management tools continues to evolve, providing investors with increasingly sophisticated analytical capabilities that can help identify opportunities and manage risks more effectively.

Conclusion

Responsible crypto investing in 2025 requires a sophisticated approach that balances the tremendous opportunities digital assets offer with careful risk management and strategic thinking. Success comes not from speculation or following trends, but from educating yourself, implementing systematic strategies, and maintaining discipline through market cycles.

The key principles—thorough research, appropriate position sizing, diversification across crypto sub-sectors, systematic risk management, and proper security practices—provide a framework for building wealth in the digital economy whilst avoiding the pitfalls that trap unprepared investors.

As the crypto market continues to mature and institutional adoption accelerates, those who approach digital asset investing with responsibility, strategy, and proper risk management will be best positioned to benefit from this transformative asset class. The future belongs to investors who combine the innovative potential of cryptocurrencies with time-tested investment principles—creating portfolios that can thrive in both bull and bear markets whilst contributing to the development of a more decentralised financial system.

Remember, successful crypto investing is a marathon, not a sprint. By focusing on long-term value creation, maintaining proper risk management, and staying informed about technological developments, you can position yourself to benefit from the ongoing digital asset revolution whilst protecting your financial future.

Find out why crypto investors need portfolio management tools to track performance, manage risk, and make data-driven investment decisions.

Best crypto portfolio management tools for retail investors compared - learn how CoinIQ delivers smarter, unified portfolio insights.

Find out why crypto investors need to understand position- and portfolio-level drawdowns and the best data-driven methods to manage them.