The Best Crypto Portfolio Management Tools for Retail Investors (And How CoinIQ Stands Out)

Author

Abbas A.

Date Published

If you’ve ever tried to keep track of your crypto portfolio across a couple of exchanges, a wallet or two, and maybe a cheeky DeFi position you forgot about, you’ll know the pain...where is all my money sitting?

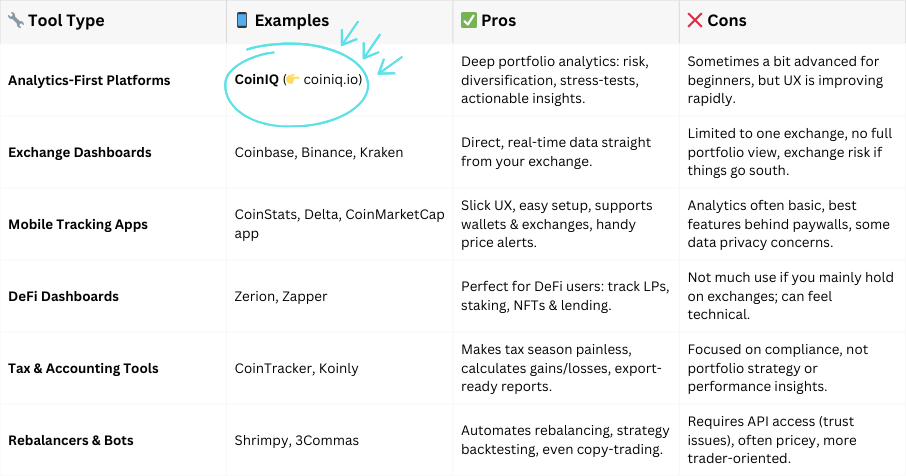

Managing a crypto portfolio isn’t just about seeing balances anymore — it’s about understanding risk, performance, diversification, and making smarter decisions. The good news? There are plenty of crypto portfolio management tools out there. The not-so-good news? Each comes with its quirks.

Let’s break down the main types of tools, their pros and cons, what retail investors really want, and how CoinIQ is carving out a new space in this market.

What Retail Investors Actually Want in a Portfolio Tool

When it comes to managing their crypto, most retail investors are really just after a simple but powerful solution. At the top of the wish list is a single dashboard that pulls everything together - exchanges, wallets, and DeFi positions all in one place. Nobody wants to log in to five different apps just to figure out where their tokens are.

Alongside that, investors crave analytics that actually mean something. It’s not enough to be told “your portfolio is down 10%.” People want to know why it’s down, whether it’s a market-wide move, an overweight position in one asset, or simply bad timing on a trade. Insights like this help them decide what to do next, instead of just staring at a red percentage.

Another key need is tax-friendly reporting. The crypto space can get messy fast, with multiple wallets and exchanges generating hundreds of transactions. Having clean exports that can go straight to an accountant or into tax software saves huge amounts of time and stress at the end of the year.

There’s also a growing appetite for clear visibility into portfolio risks. Retail investors want diversification scores, drawdown stats, and liquidity risks explained in plain English, not buried in complex charts. Add to this the expectation of affordable pricing, with free tiers that are actually useful and clear upgrade paths, and you get a sense of what “good value” looks like in this space. And of course, it all needs to come with a solid user experience. If a platform feels like it was designed in the early 2000s, most investors will simply close it and move on.

The Missing Piece: What Would Actually Add Value?

The problem with many existing tools is that they stop at surface-level tracking. Yes, they show balances and prices, but beyond that, they often fall short. What retail investors really need are platforms that deliver actionable insights tailored to their own portfolios. Instead of generic alerts about Bitcoin dipping, they want something more contextual: for example, a notification that says, “Your portfolio is overexposed to ETH, which increases your volatility risk.” That’s advice you can actually act on.

Investors are also calling for tools that surface clear, digestible risk metrics. Things like volatility, concentration levels, and liquidity risk should be front and centre - and explained in ways that make sense even to someone who isn’t a professional trader. On top of that, tax-aware suggestions are a big value-add. Imagine a tool that not only tells you your portfolio is underperforming but also suggests a tax-loss harvesting trade that could soften the blow.

Another game-changer would be platforms that allow investors to move seamlessly from insight to action. Right now, most people have to juggle multiple apps - one for tracking, another for insights, and yet another for trading. Consolidating that workflow would be a huge step forward. Finally, there’s the matter of on-chain risk detection. Retail users often have no idea when a DeFi protocol is in trouble or when whales are moving large amounts of tokens. Tools that can spot these risks and explain them in plain, non-technical language would be genuinely invaluable.

In short, the missing piece isn’t just more data, it’s more guidance. Investors want less noise, more clarity, and insights they can trust.

CoinIQ: A Smarter Way to Manage Your Crypto Portfolio

This is where CoinIQ steps in. Instead of being “just another tracker”, CoinIQ positions itself as an analytics-first crypto portfolio management tool.

Here’s what makes it stand out:

- Analytics, not just balances - CoinIQ digs into volatility, drawdowns and correlations, giving you a proper understanding of your portfolio’s behaviour.

- AI-driven insights - with features like Diversification analysis and portfolio-specific commentary, CoinIQ explains why something is happening, in plain English.

- Anomaly index - CoinIQ’s proprietary anomaly index highlights irregular price and volume moves, helping users flag potential rug pulls before they happen.

- Unified view + action - link wallets and exchanges, track everything, and even execute swaps directly in the platform.

- Education baked in - from blogs to explanations of metrics, it helps investors learn while managing.

For retail investors in crypto, who want to actually understand their portfolio, not just watch prices, CoinIQ is a refreshing option, as also mentioned in Dang.

Final Thoughts

There isn’t a single “best crypto portfolio management tool” for everyone. If you’re DeFi-heavy, you’ll love Zerion or Zapper. If you need tax help, go Koinly or CoinTracker. If you’re just casually watching prices, Delta or CoinStats do the job.

But if you’re ready for insights that help you decide what to do next with your crypto, CoinIQ is the one worth adding to your toolkit.

Find out why crypto investors need portfolio management tools to track performance, manage risk, and make data-driven investment decisions.

Find out why crypto investors need to understand position- and portfolio-level drawdowns and the best data-driven methods to manage them.