Digital Asset Treasury Companies: Turning Crypto into Equities

Author

CoinIQ

Date Published

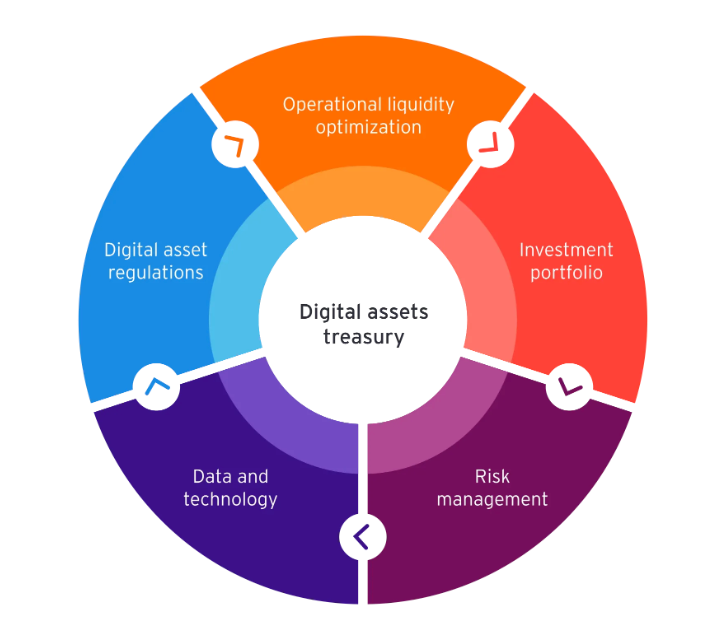

There’s a new breed of crypto-related company gaining attention, and it’s not the usual collection of mining outfits, exchanges, or blockchain tech firms. Enter Digital Asset Treasury companies, or DATs for short. These are public companies that buy and hold crypto – mainly Bitcoin, but not exclusively – and give traditional investors a way to get exposure to digital assets through familiar public equities. Think, crypto exposure with training wheels.

What Exactly Is a Digital Asset Treasury Company?

A DAT is a company that acts as a sort of publicly listed vault for digital assets. Instead of building tech products or running decentralised apps, these companies raise capital and use it to acquire and hold crypto, usually in large amounts. They’re listed on stock exchanges, just like any other public company, and can therefore be bought and sold through brokerage accounts. No need for wallets, seed phrases, or crypto exchanges.

They’re basically copying the blueprint laid out by MicroStrategy (now called Strategy, ticker: MSTR), which famously pivoted from software to Bitcoin acquisition, becoming one of the largest corporate holders of BTC in the world.

Why Are People Interested?

Well, first off, these companies can sometimes offer more crypto exposure per share over time than simply buying the underlying asset directly. Sounds odd? Let’s break it down.

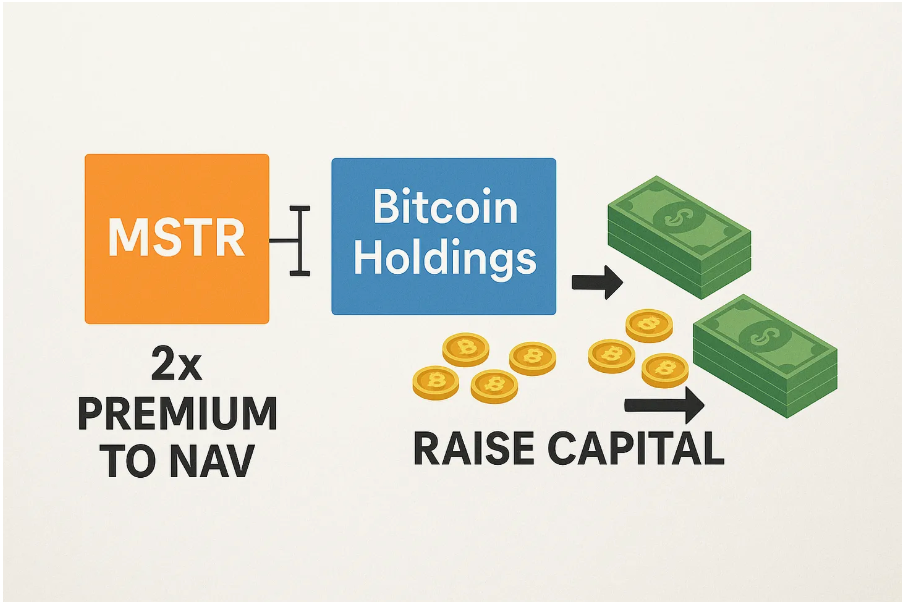

Imagine MSTR is trading at twice the value of its Bitcoin holdings (what’s called a 2x premium to NAV – Net Asset Value). You might think that’s overvalued. But if the company is good at using market instruments, like issuing convertible debt, or selling options during periods of high stock volatility, it can raise more capital and buy more BTC.

If done right, this grows the number of Bitcoin per share (BPS). So even if you bought in when it was “overvalued,” your BTC exposure per share could surpass spot exposure over time. In 2023, MSTR managed to grow its BPS by 74%. If it keeps that up (or even does half that), holding shares could actually net you more Bitcoin in the long run.

Of course, there are a few conditions for that to play out:

- Markets don’t always price things perfectly. Irrational exuberance and all that.

- The stock has to stay volatile enough for the company to pull off these financial gymnastics.

- Management needs to be sharp enough to play the capital markets game well.

Why This Matters

One of the key reasons DATs are gaining traction is because they lower the barrier to entry for traditional investors. Setting up a MetaMask wallet or figuring out self-custody isn’t everyone’s cup of tea. But buying a share? That’s something pension funds, retirement accounts, and retail investors understand.

DATs effectively “wrap” crypto in a suit and tie, presenting it through a system investors are already comfortable with.

And here’s a twist: unlike ETFs, which can buy and sell their holdings frequently based on inflows and redemptions, DATs tend to lock their crypto away for good. This makes them behave more like closed-end funds, and from a market dynamics perspective, this could help reduce sell pressure on the underlying coins. Less selling = better price support. In theory, at least.

A Few DATs to Know

Twenty One Capital (NASDAQ: CEP)

Led by Jack Mallers, known for his Bitcoin evangelism, Twenty One is following the MSTR model. What’s interesting here are the backers, Tether, SoftBank, and Cantor Fitzgerald. This gives the company credibility and resources. It’s also smaller than MSTR, meaning it might have more room to grow and potentially increase its BTC-per-share faster.

DeFi Development Corp (NASDAQ: DFDV)

Formerly known as Janover, this was the first U.S.-based DAT to focus not on Bitcoin, but on Solana (SOL). There’s a strong case to be made for this approach: SOL is earlier in its lifecycle than BTC, has higher volatility (which means more opportunities to harvest that through financial instruments), offers staking rewards (yield), and currently doesn’t have many competing public proxies like ETFs or mining stocks. All that gives DFDV some unique angles.

Sharplink Gaming (NASDAQ: SBET)

This one’s focused on Ethereum, and it’s backed by none other than Consensys—the Ethereum software giant. As the first ETH-focused DAT, it could appeal to investors looking for ETH exposure without diving into DeFi themselves.

Final Thoughts

DATs sit at a fascinating crossroads between crypto and traditional finance. They’re a bit of a Trojan horse, smuggling digital assets into portfolios that might otherwise steer clear of anything remotely crypto-native. Whether you’re a retail investor looking for simplicity, or an institution restricted to equity investments, DATs offer a backdoor into the world of digital assets.

It’s still early days, and not all DATs are created equal but, if this model continues to prove successful, we might be looking at an entirely new asset class of publicly traded companies whose primary job is to own crypto well. In the meantime, keep your eyes peeled, this corner of the market is just getting warmed up.