Behavioural Finance: The Underestimation of Crypto Volatility

Author

CoinIQ

Date Published

Investing in cryptocurrency can be exciting, but many investors underestimate how extreme price swings can be in the cryptocurrency market. Behavioral finance shows that psychological factors, emotions, and cognitive errors often drive investment decisions more than data, which makes volatility easier to ignore and harder to manage.[1]

Behavioral finance and cryptocurrency volatility

Behavioral finance explores how emotions, biases, and other psychological factors shape financial decisions, especially in speculative environments like cryptocurrency. In contrast to traditional finance, which assumes rational investors, behavioral finance helps explain irrational behavior, misjudged risks, and misguided investment decisions in highly volatile crypto assets.[2][1]

Understanding volatility in the cryptocurrency market

Volatility in the cryptocurrency market is amplified by market sentiment, liquidity conditions, and rapid shifts in investor attention. When liquidity is thin, even small orders can move prices significantly, making cryptocurrency investments more sensitive to sudden changes in demand or supply. Misconceptions and myths about crypto, such as assuming guaranteed quick profits or total illegitimacy, create common challenges that distort risk perceptions and lead to poor financial decisions.[3][1][2]

Behavioral finance framework for crypto decision-making

A behavioral finance framework for cryptocurrency highlights how biases, emotions, and cognitive errors impact investment decisions and price dynamics. Overconfidence, loss aversion, and herd behavior can cause investors to chase rallies or panic-sell, resulting in cycles of hype and fear that amplify cryptocurrency returns in both directions. Recognizing these psychological factors allows investors to refine their decision-making and reduce irrational behavior in both spot and futures market trading.[4][5][1]

Key behavioral biases in cryptocurrency investments

Several biases frequently affect cryptocurrency investments, including overconfidence, herd behavior, anchoring, and loss aversion. These biases lead to suboptimal financial decisions, such as concentrating too much capital in a single token, ignoring downside risks, or refusing to cut losses due to emotional attachment. Education about behavioral finance, blockchain technology, and market structure can help investors identify these biases and improve their investment decisions.[6][1][4]

Cryptocurrency market volatility and investor attention

The cryptocurrency market is highly sensitive to investor attention, media coverage, and social signals, which can rapidly shift market sentiment. Spikes in investor attention, often triggered by news, influential posts, or regulatory headlines, can accelerate price discovery but also produce short-lived bubbles and sharp corrections. Behavioral finance research shows that when attention and emotions peak, irrational behavior becomes more likely, amplifying volatility and distorting perceived opportunities.[7][8][9]

Liquidity, price discovery, and market dynamics

In the cryptocurrency market, liquidity strongly affects how quickly information is reflected in prices and how violent swings can become. High liquidity supports smoother price discovery, while low liquidity makes the market more vulnerable to large moves from relatively modest orders. Because many traders rely on sentiment and narratives rather than fundamentals, cognitive errors can slow or distort price discovery compared with more established traditional finance markets.[5][10][2]

Trading behavior in the bitcoin market

Trading behavior in the bitcoin market is a prime example of how behavioral finance and cryptocurrency interact. Emotions such as fear, greed, and FOMO drive aggressive buying near peaks and panic selling during drawdowns, feeding boom‑and‑bust cycles. These emotional waves, combined with limited liquidity at extremes, create sharp, sudden moves that surprise both new and experienced traders.[1][3][7]

Risk-averse agents in the cryptocurrency market

Risk-averse agents tend to trade less frequently, focus more on downside protection, and seek better education about blockchain technology and crypto market structure. Their cautious investment decisions can dampen extreme volatility at the margin, especially when they allocate gradually and avoid concentrated bets on speculative tokens. As central bank digital currencies (CBDCs) and regulated products grow, risk-averse agents may help bridge the gap between traditional finance and the cryptocurrency market.[11][10][5]

Comparative view: cryptocurrency vs traditional finance

Traditional finance markets typically feature deeper liquidity, clearer regulation, and more robust valuation frameworks, which can moderate volatility compared with many crypto assets. Stock returns often move in response to fundamentals and macro indicators, whereas cryptocurrency returns react more strongly to sentiment, narratives, and perceived technological opportunities. This structural difference makes behavioral finance especially valuable for understanding cryptocurrency investments, where psychological factors and narratives can overshadow cash‑flow‑based analysis.[10][2][1]

Price discovery across markets

Price discovery in cryptocurrency markets often occurs in fragmented venues with varying liquidity, leverage, and transparency. Because many participants are retail traders influenced by social media and community narratives, price discovery is more prone to short‑term noise and cognitive errors than in many traditional finance markets. Nevertheless, blockchain technology improves transparency of on‑chain flows and can offer new data for understanding trading behavior, investor attention, and evolving trends.[2][11][10]

Outcomes of underestimating crypto volatility

Underestimating volatility in cryptocurrency can lead to oversized positions, insufficient diversification, and poorly planned exit strategies. When markets move against these positions, investors often react emotionally, crystallizing losses or abandoning previously defined plans, which undermines long‑term success. Behavioral finance shows that preparing for extreme moves in advance, through position sizing, scenario planning, and clear rules, can mitigate these outcomes.[9][5][1]

Impact on investor decision-making and output decisions

Investor perceptions of risk and volatility strongly shape decision-making, from entry timing to portfolio allocation and rebalancing. When investors focus mainly on recent gains and ignore historical drawdowns, they tend to overestimate potential returns and underestimate downside risk, leading to fragile portfolios. Conversely, understanding behavioral finance can nudge investors toward more disciplined output decisions, such as gradual scaling, pre‑defined risk limits, and diversified project management across different assets.[7][9][1]

Future trends in behavioral finance, CBDC, and crypto volatility

Future research and tools in behavioral finance are likely to integrate machine learning, sentiment analysis, and on‑chain data to anticipate irrational behavior and shifts in volatility. As CBDC initiatives, tokenization, and more regulated products develop, the line between traditional finance and the cryptocurrency market may blur, creating new opportunities and common challenges for investors. Better education about cognitive errors, biases, and emotional triggers can help investors adapt their decision-making to these trends and navigate changing market structures.[5][11][7]

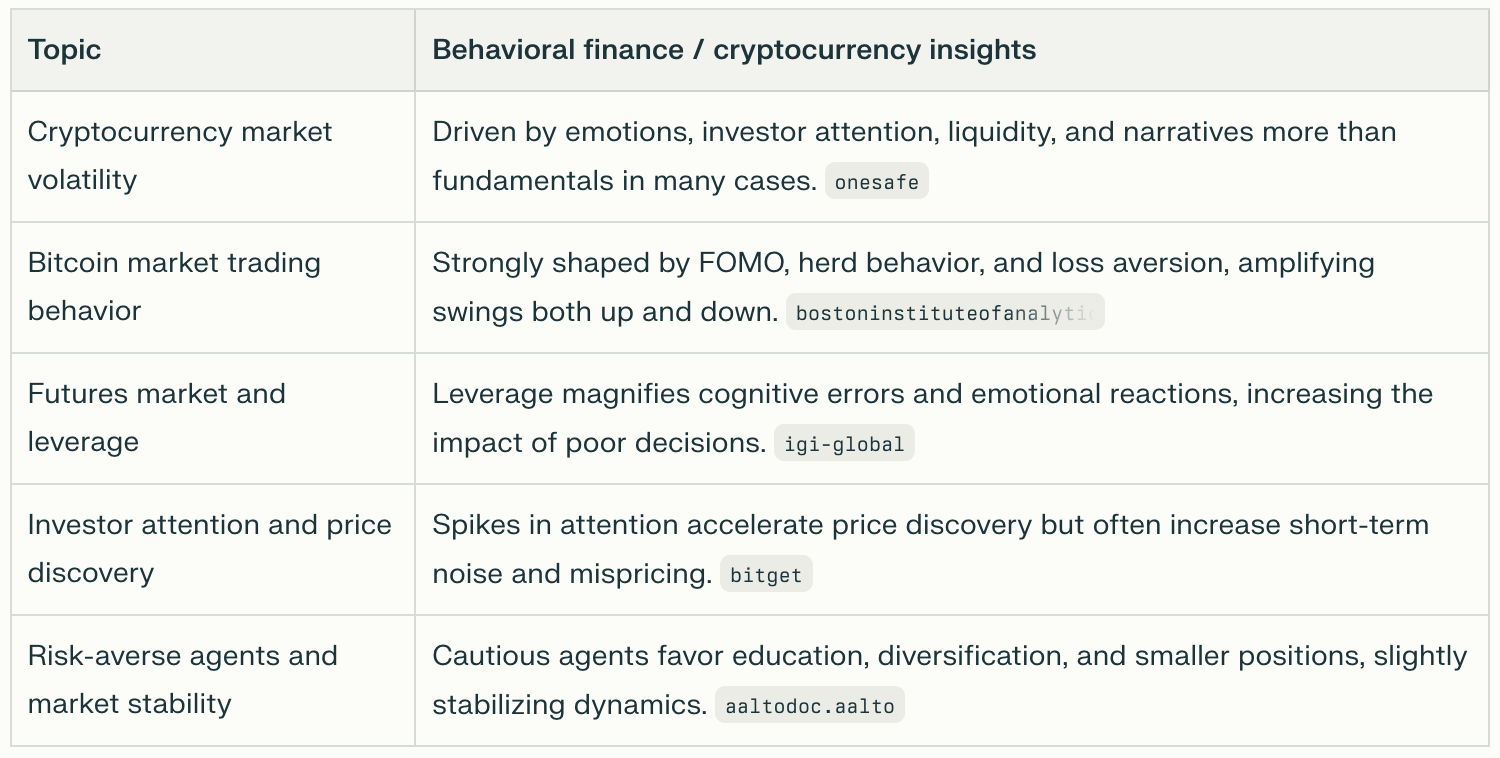

Behavioral finance, cryptocurrency market, and key themes

Practical strategies for better cryptocurrency investment decisions

Applying behavioral finance insights can improve cryptocurrency investment decisions and overall project management. Useful approaches include:[1]

- Defining position sizes and maximum losses per trade to counter overconfidence and impulsive emotions.[5]

- Using checklists to spot biases and cognitive errors before executing trades or reallocating a portfolio.[9]

- Maintaining a written plan for investment decisions, including conditions to enter, exit, or pause trading when volatility spikes.[1]

FAQ (optimized with behavioral finance and cryptocurrency keywords)

What is behavioral finance and how does it relate to the underestimation of crypto volatility?

Behavioral finance studies how psychological factors, such as emotions and biases, affect financial decisions and investment decisions. In the cryptocurrency market, these factors often lead investors to underestimate volatility and take risks that do not match their true risk tolerance or long‑term goals.[2][1]

Why do investors tend to underestimate the volatility of cryptocurrencies?

Investors frequently rely on recent price action, social narratives, and limited historical data, which can create misconceptions and myths about future stability. This narrow focus, combined with optimism and herd behavior, causes many to misjudge how quickly cryptocurrency prices can move.[7][9]

What psychological biases contribute to the misjudgment of crypto volatility?

Common biases include overconfidence, herd behavior, anchoring on previous highs, and loss aversion that delays selling when conditions change. These biases distort perceptions of risk and reward, leading to irrational behavior and fragile strategies in both spot and futures market trading.[4][6]

How can understanding behavioral finance help investors better navigate the risks of crypto markets?

By recognizing biases and emotional triggers, investors can design rules and processes that support rational decision-making, such as pre‑defined exits and position limits. This structured approach improves the quality of financial decisions, helps capture genuine opportunities, and reduces the impact of short‑term sentiment.[2][1]

What strategies can investors use to manage perceptions of volatility in cryptocurrency investments?

Investors can use diversification, staged entries, and dollar‑cost averaging to smooth exposure and reduce the emotional impact of price swings. Regular education, reflection on past decisions, and monitoring trends with a long‑term perspective all support more stable, success‑oriented behavior in cryptocurrency investments.[7][5]

References

- https://www.meegle.com/en_us/topics/behavioral-finance/behavioral-finance-and-cryptocurrency

- https://www.igi-global.com/chapter/behavioral-finance-and-cryptocurrency-market/326994

- https://www.onesafe.io/blog/the-psychology-of-crypto-trading-navigating-resistance-levels-and-market-volatility

- https://theses.ubn.ru.nl/server/api/core/bitstreams/1b1b8f0b-36aa-4cd5-9a8b-805175b11683/content

- https://boa.unimib.it/retrieve/dda2f82c-158e-4fc7-a742-0b59e3bbe93f/Aboueldahab et al-2025-InPACT-PrePrint.pdf

- https://digikogu.taltech.ee/et/Download/411dd831-abca-4442-bb75-7e3d2171bd49

- https://bostoninstituteofanalytics.org/blog/behavioral-finance-in-2025-how-psychology-is-driving-market-trends/

- https://www.bitget.com/news/detail/12560605085663

- https://pdfs.semanticscholar.org/236d/56a9bf1b688c67db42ac8099843b66b4cd80.pdf

- https://aaltodoc.aalto.fi/server/api/core/bitstreams/c9b8f3b3-1b41-4752-ad07-3fc002c6f3b8/content

- https://blogs.cfainstitute.org/investor/category/behavioral-finance/

- https://blog.ueex.com/cryptocurrency-behavioral-finance/

- https://tesi.luiss.it/39392/1/762031_DURANTE_MATTEO.pdf

- https://is.vsfs.cz/th/kdkw6/Kamran_Safarli_Thesis_Final.pdf

- https://unitesi.unive.it/retrieve/518982e2-4c47-4b85-aac0-9500d661e88e/866706-1267606.pdf

- https://essay.utwente.nl/fileshare/file/91384/Pos_MA_BMS.pdf

- https://www.ewadirect.com/proceedings/aemps/article/view/22518/pdf

- https://www.behavioraldesign.academy/blog/behavioral-crypto

- https://www.wisdomtree.com/investments/blog/2018/02/06/a-discussion-on-dividends-behavioral-finance-and-crypto

Best crypto portfolio management tools for retail investors compared - learn how CoinIQ delivers smarter, unified portfolio insights.

Discover the differences between correlation and beta, their applications, and their relationships within the cryptocurrency market.

Discover peak-to-trough drawdown and effective strategies for managing your limits in cryptocurrency investments.