Why Your Crypto Wallet Sucks (And How That's Set to Change)

Author

Abbas A.

Date Published

The pain points holding wallets back and the innovations that fix them. This post is a collaboration between CoinIQ and Steven Vincent. Steven is the creator of Intellipedia.AI, The Singularity Project, and BullBear Trading, exploring the intersections of AI, markets, and human evolution. Together, we dug into a topic close to every crypto investor’s heart – why most crypto wallets fall short, and how that’s about to change.

Crypto wallets have a reputation for being clunky, confusing, and downright intimidating for new users. There's an endless cycle: you convince a mate to dive into Web3, point them at MetaMask, and suddenly you’re plunging into seed phrases and gas fees, fielding their lingering suspicion that crypto might just be a very elaborate scam. Sound familiar?

Despite crypto’s staggering potential, real-world adoption is still crawling along. The culprit? Terrible user experience. Until wallets are easier and safer, Web3 will remain a brilliant idea in need of a breakthrough.

We Need a Crypto "Netscape Moment"

Back in the early ‘90s, the internet was reserved for the technical elite; Mosaic and Netscape changed everything, making the web clickable, friendly, and fun. The leap from command lines to browsers sparked a 300% burst in internet users, then continued to explode. Today, Web3 desperately needs its own turning point.

As Steven Vincent points out, crypto wallets are still an alien mystery for most people. The "seed phrases" and "code is law" mindset make newcomers anxious, while confusing interfaces scare off even the tech-inclined. What’s needed is the Steve Jobs or Marc Andreessen of Web3, a visionary who can tame this chaos with simplicity and style.

Adoption Numbers: The Reality Check

So, just how widespread is crypto really?

Estimates put global crypto asset owners between 560 and 660 million as of late 2024-around 7% of the planet. But owning some crypto doesn’t make you a regular wallet user. In fact, only about 3% of holders use their wallet each month; that’s just 20 million genuinely active participants in a space packed with hype.[1][2][3]

Blockchain.com, for example, claims 90 million wallets created, but that’s over its entire lifespan, and many users have several wallets. Statista logged just 23 million wallet downloads in March 2024 - again, more proxy for installs than actual engagement. Popular wallets like MetaMask, Phantom, and Trust Wallet report monthly active users in the 10-30 million range. Even so, the reality is sobering: perhaps 3-4% of crypto holders are active. Measured against total world population, it’s one-third of one percent.[4]

Bottom line? There's a massive, untapped opportunity waiting for smarter solutions and simpler onboarding.

What's Still Broken With Wallets?

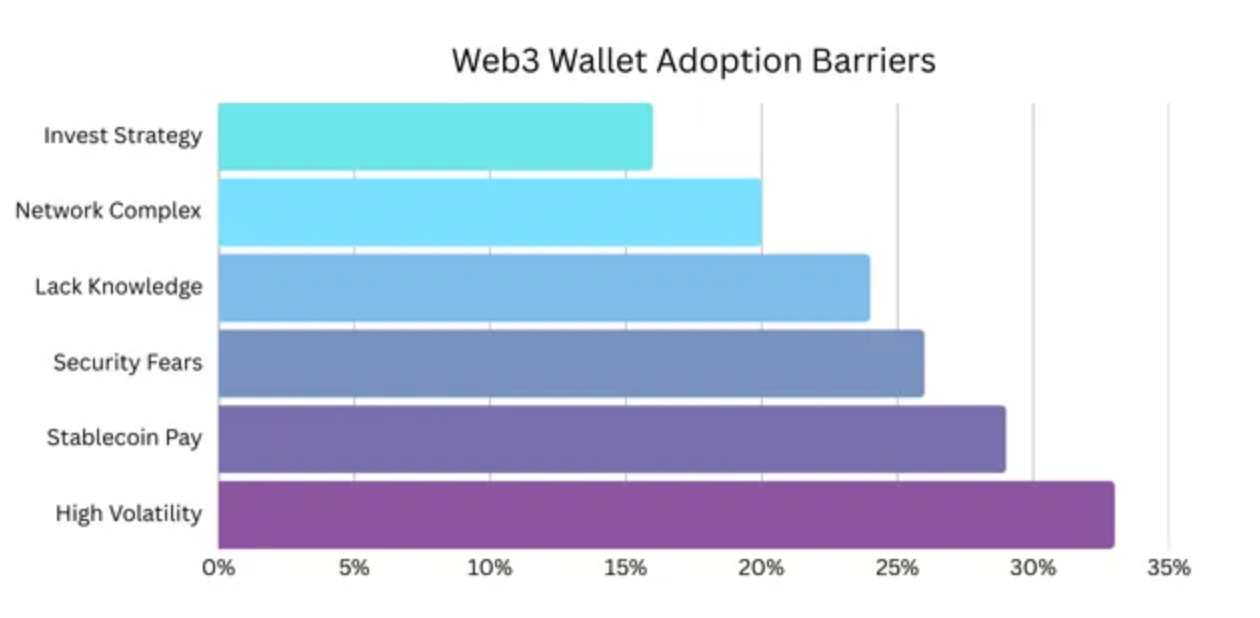

Why is adoption so slow? A recent survey nailed the main culprits: network complexity, onboarding headaches, and security concerns. But these issues aren’t set in stone-change is already underway.[5][6][7]

The "Perfect Storm" of Bad

Main barriers preventing Web3 wallet adoption among users

- Seed phrases are nuts: Asking normal people to securely store 12 random words for years, on pain of losing their money, is a recipe for disaster. The failure rate is massive; forget your phrase and that's it, game over.[8][9][10]

- Cryptic interfaces: Wallets are built by engineers for engineers. You’re greeted by hexadecimal addresses and prompts to “sign payloads,” which might as well be written in ancient Greek.[11]

- No safety net: Traditional banking lets you reset passwords. In crypto? Lose your keys and your assets are gone forever. That’s terrifying for most users.

- Regulation slows you down: Whenever you try to convert between fiat and crypto, expect tedious identity checks and KYC paperwork.

- Use case barriers: So you've got a wallet. Now what? Beyond speculative trading and NFTs, mainstream use cases remain thin on the ground.

Speaking of better crypto experiences, if you're already managing a portfolio across multiple wallets and exchanges, you know the pain of fragmented data and endless spreadsheets. That's where CoinIQ comes in. A crypto portfolio management platform that unifies all your crypto holdings in one place, delivering personalized insights on returns, volatility, and diversification. Beyond the usual analytics, CoinIQ's anomaly index spots unusual market movements before they hit your portfolio, while its AI generates actionable portfolio news summaries tailored to your specific holdings. No more jumping between five different apps to understand your crypto performance - just intelligent, unified portfolio management that actually helps you make better decisions.

The Light at the End of the Wallet Tunnel

There’s good news: the crypto world has finally woken up to its UX nightmare. Fixes are coming thick and fast, with a new wave of wallet tech set to rewrite the playbook.

Comparison of different Web3 wallet models and their trade-offs

Game-Changing Solutions

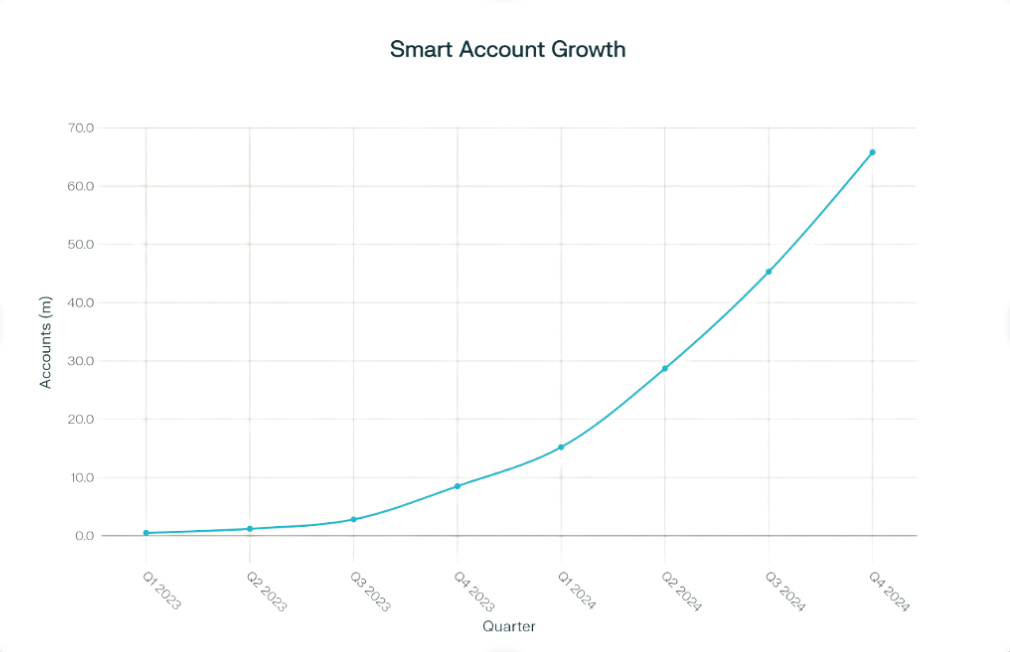

Account abstraction represents the biggest breakthrough in wallet technology, transforming simple key containers into smart, programmable contracts that can handle spending limits, social recovery, and automatic gas payments. Instead of memorising cryptographic keys, you can log in with your face or fingerprint - that's a leap worthy of the smartphone era. The momentum has been staggering: account abstraction deployments exploded from 7 million in 2023 to over 40 million in 2024, driven primarily by major wallets and reward applications.[13][25][26]

Meanwhile, seedless wallets use advanced cryptography to split your private key across multiple secure locations, enabling biometric login without the terror of losing a handwritten phrase. Embedded wallets take this further by creating accounts automatically when you sign up for apps - particularly brilliant in Web3 gaming, where you just play while all the blockchain complexity fades into the background. Social recovery systems like Argent let you reclaim access through trusted friends rather than scrambling for lost seed phrases, while gas abstraction hides transaction fees entirely, sponsoring costs or accepting payment in any token. It's like how internet browsing would be unusable if you needed special tokens for every website visit.[12][22][23]

The infrastructure improvements extend to multi-chain support, where modern wallets handle multiple blockchains seamlessly behind one interface, eliminating the need to juggle separate apps for different networks. Even security has improved dramatically - hardware wallets now look like sleek contactless cards, and wallet interfaces actively warn users before risky transactions, creating safety nets without sacrificing usability.

Smart account adoption growth showing exponential increase since ERC-4337 launch

Standardisation: The Final Piece

Fragmentation and poor standards used to make wallets nearly unusable. That’s changing, fast. Protocols like WalletConnect let apps interact with any wallet, and Sign-In with Ethereum is making crypto logins familiar and simple. The “Key Manager” model-managing all your keys and credentials behind a unified UI-is the next logical step, borrowing from how browsers and OSes already handle passwords and certificates.

Modern wallets combine passkeys (biometric login), MPC (multi-party computation), and account abstraction to ditch seed phrases entirely.

How Tech Constraints Shaped the Mess

It's not just bad design, crypto's underlying architecture itself complicated things for everyone. Gas fees turn every transaction into a maths puzzle, with costs swinging wildly based on network demand, leaving users guessing whether their transaction will cost $2 or $50. The confusion is so severe that 90% of users abandon transactions when confronted with high or confusing fees. Smart contract interactions compound this problem by presenting users with arcane hexadecimal strings and cryptic function calls instead of human-readable prompts like "Approve $100 USDC"-a challenge that stumps even experienced developers, let alone everyday users.[17][18][19][14]

The seed phrase security model embodies crypto's fundamental tension between cryptographic elegance and practical usability. Losing your recovery phrase means permanent loss of funds, but making phrases too simple exposes users to hacking-a lose-lose scenario that has resulted in an estimated 20% of all Bitcoin being locked away forever due to forgotten phrases. Cross-chain operations add another layer of complexity, requiring users to navigate bridges, manage multiple gas tokens, and configure endless network settings just to use the same application across different blockchains. Finally, the mempool problem leaves users completely in the dark once they submit transactions-no progress bars, no status updates, just a black box where their money disappears until it maybe, eventually, gets processed. Users expect the feedback and control they get from traditional apps, but blockchains simply don't offer that transparency yet.[21][10]

How Modern Tech Makes UX Better

Developers now focus on hiding the ugly bits, letting users interact with crypto as simply as they do with Venmo or Apple Pay. Account abstraction transforms wallets into programmable smart contracts that handle social recovery, transaction batching, and custom security policies-all completely invisible to users who simply see a smooth login and transaction experience. Layer 2 networks like Arbitrum and Polygon complement this by delivering cheap, instant-finality transactions that can bundle complex multi-step actions while slashing fees to pennies.[9][17][12][22][23][24]

Gasless transactions represent perhaps the biggest UX breakthrough, with paymasters and meta-transactions allowing apps to sponsor all blockchain fees automatically. Projects like Circle and Gelato have made this sponsorship model a practical reality, letting users interact with crypto without ever touching gas tokens. Intent-driven design takes this abstraction further-instead of manually configuring swap routes and gas prices, users simply declare their goal like "send $100" and sophisticated routing protocols handle all the technical complexity behind the scenes. Progressive Web Apps eliminate the fragmentation of browser extensions and app store approvals, letting wallets run seamlessly in any browser, while cross-chain infrastructure from protocols like LayerZero and Chainlink CCIP makes multi-blockchain operations completely transparent to users. The result is an ecosystem where blockchain complexity fades into the background, leaving only the smooth user experience that crypto has always promised.[22][24][27]

While exchanging crypto for a product or service is a natural purpose for a Web3 wallet, it's important to consider the opposite directional flow of value exchange. Users should also be able to easily receive crypto from a Web3 application as a reward for their valuable contributions. intellipedia.ai and its soon to be released AI voice agent, “Inti”, will reward users for their data and interactions with the platform through awards of INTI tokens. User data is the most important commodity resource of the new Intellinomics, so rewarding users for high quality contributions is an above board way to mine that value while making the user an honored participant in a mutually beneficial ecosystem.

What the Future Holds

Soon, creating a wallet will be as easy as signing in with Google. Gas fees and multi-chain headaches will disappear. Social recovery will let you sleep easily at night, and mainstream spending becomes frictionless. The Web3 wallet experience will be indistinguishable from regular online banking-only with genuine ownership and decentralisation.

With account abstraction, passkeys, embedded wallets, and smart standards, the next generation of crypto wallets won’t feel like crypto at all. They’ll just work.

We're on the verge-within 12-24 months-of Web3 wallets that feel as smooth as the best fintech apps out there. When that happens, the next billion users won’t even realise they’re using blockchain… which is exactly how it should be.

For Steven’s own version of this article, check it out on his Substack, and don’t miss his projects like Intellipedia.AI and BullBear Trading. If you enjoyed this, I highly recommend subscribing to Steven’s Substack – his work brings a unique blend of insight and creativity to markets and beyond.

Join the discussion: Do you think mainstream crypto wallets will really reach parity with fintech apps soon? Have you had a wallet nightmare of your own? How would you redesign onboarding for Web3? Jump in below and share your thoughts!

References

1. Triple-A Crypto Ownership Data

2. Crypto.com Market Sizing Report

3. Poder360: Global Crypto Ownership 2024

4. Contrary Research on Blockchain.com Wallets

5. Cryptocurrency Wallet Adoption Statistics

6. RIF Technology Entry Barriers

9. Building Tomorrow: Overcoming Barriers

10. Gelato Guide to Account Abstraction

11. Rhinestone: Account Abstraction 2024

13. Circle: Gasless Transactions

14. Gelato Network: Gasless Transactions

15. OneKey Layer 2 Blockchain Solutions

16. TokenMinds on Blockchain Development

17. Account Abstraction: Chaos to Clarity

18. The Hidden Challenges of Ethereum Gas Fees

19. Certik: Gas Optimization Practices

20. Nextrope: Account Abstraction Ecosystem Growth

21. Prototypr: UX Problems When Designing Blockchain-Based Smart Contracts

23. Arounda Agency: Better UX for Blockchain

24. Nadcab Blog: Layer2 Solutions

25. Web3Auth: Passkeys Authentication

26. Yellow: Social Recovery Wallets 2025