🚨 New Feature: Anomaly Scores to Spot Hidden Risk

Author

CoinIQ

Date Published

Staying on top of unusual market behaviour can make all the difference, so we’ve built a new feature to help you do exactly that.

🔍 Introducing: Anomaly Score

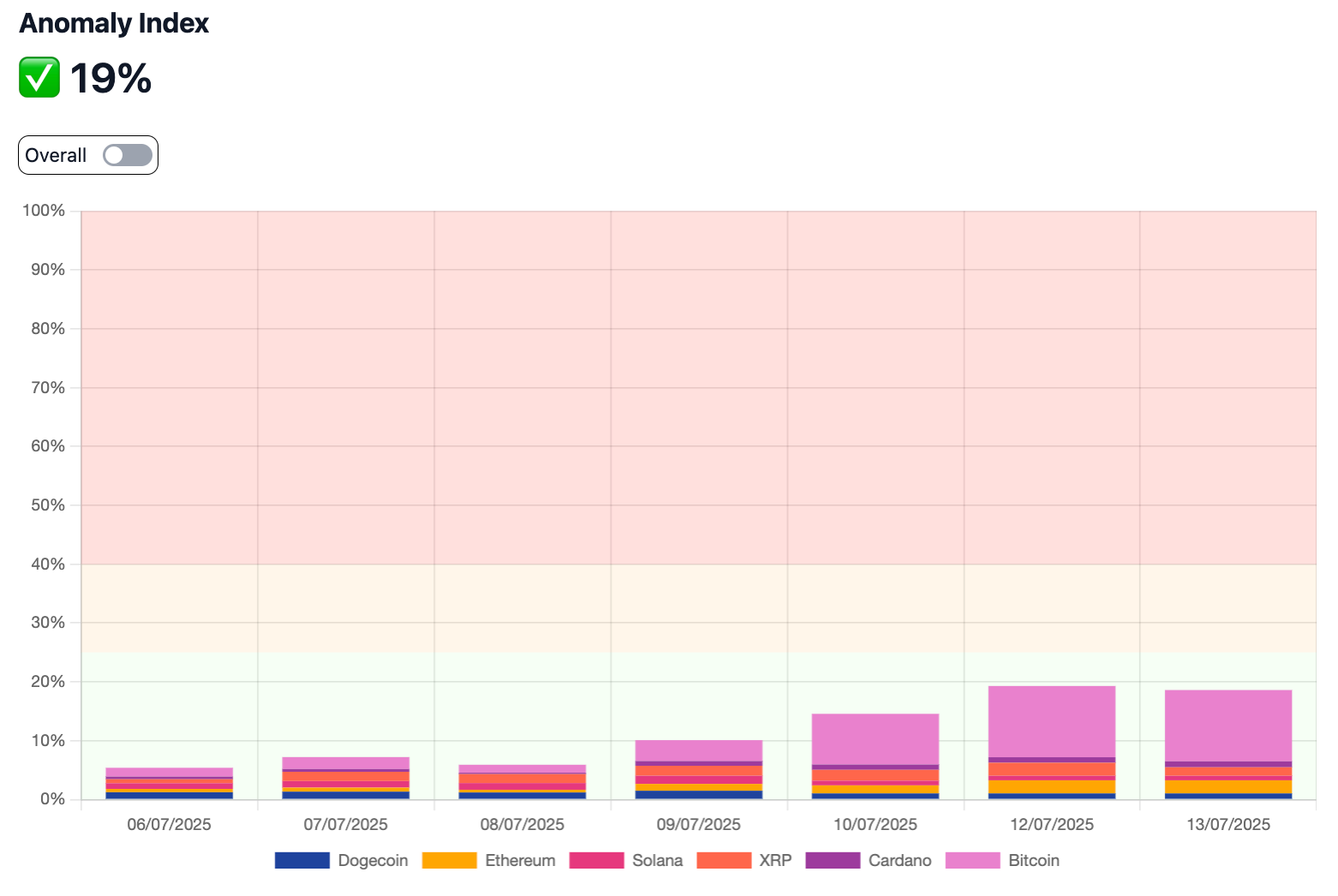

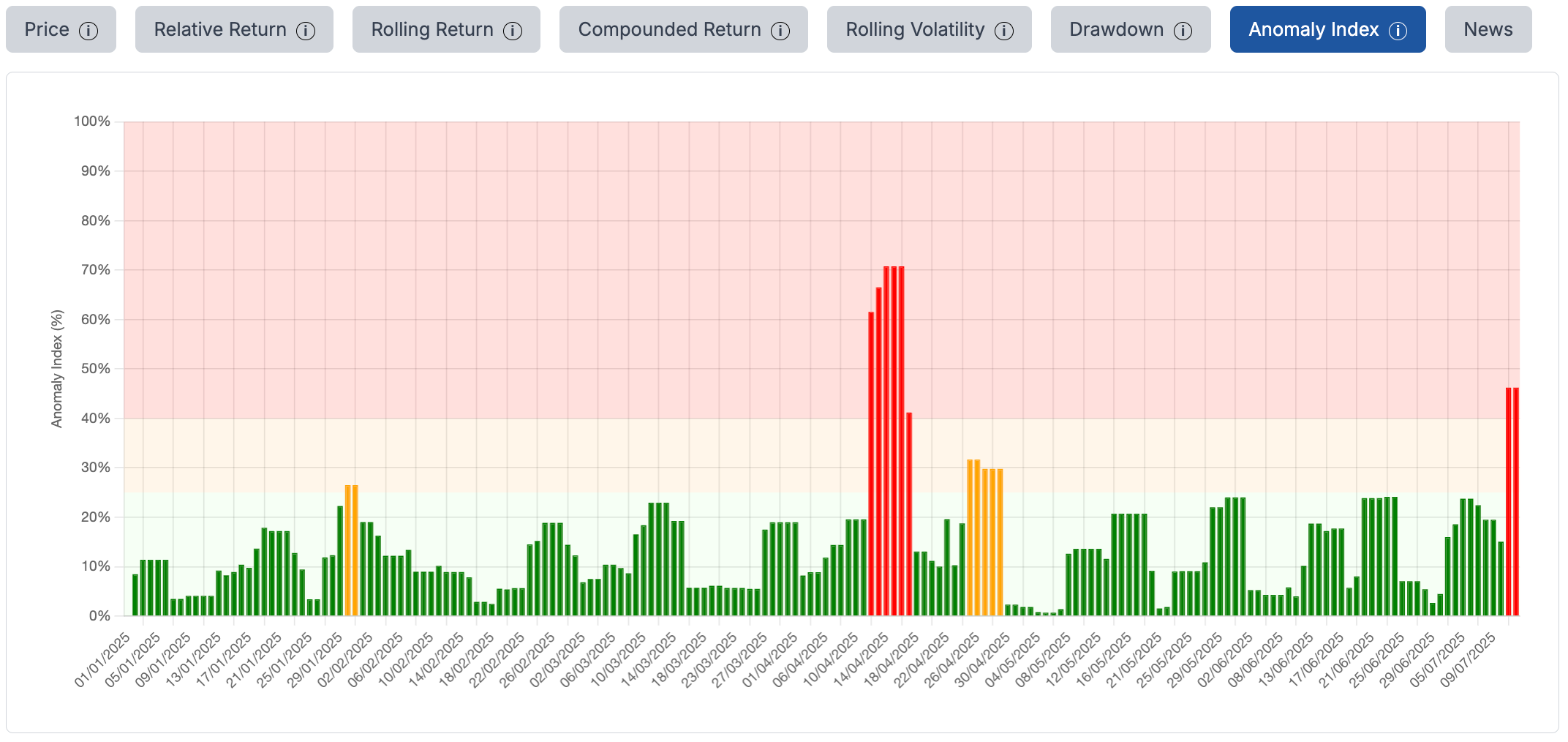

Our new Anomaly Score helps you stay on top of irregular price or volume behaviour, whether across your entire portfolio or at the individual coin level. It’s designed to highlight when something unusual is happening, so you can act faster and smarter.

Each score is based on a blend of key signals, including:

- Price Jump: Sudden spikes could signal speculative surges or coordinated pump activity.

- Volume Jump: A liquidity burst often precedes sharp moves, up or down.

- Volume Without Price: A red flag that whales might be repositioning quietly.

- Quick Drop (30%): Fast declines could indicate a sell-off or loss of confidence.

- Big Drop (50%): Significant crashes that may require immediate attention or rebalancing.

Each asset and portfolio gets a risk score between 0–100, ranked as:

🟢 Low (0–25) – Business as usual

🟡 Medium (26–40) – Worth watching

🔴 High (41–100) – Something’s off

You’ll also see a weighted average score for your full portfolio, helping you spot when risk is creeping in… even if your holdings look fine on the surface.

You can also explore historical anomaly scores to see how a position’s behaviour has evolved over time, handy for spotting patterns or recurring red flags.

💡 Why it matters

Crypto markets move fast, and not always for obvious reasons. By quantifying unusual behaviour, Anomaly Scores give you an edge in spotting risk early, making it easier to protect your portfolio or capitalise on emerging opportunities. It’s a unique approach, and one we believe adds a whole new layer of context to your holdings.

👉 Check it out now at portal.coiniq.io

And while you're there, explore the rest of our growing feature set of smarter tools for smarter crypto investors. Let us know what you think!